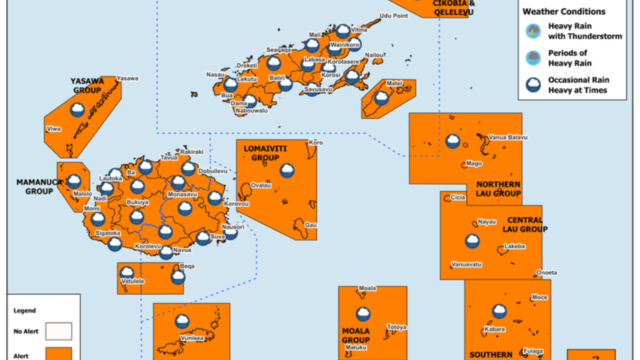

Nearly 80 percent of Fiji’s micro, small and medium enterprises are impacted by natural hazards each year, leaving many without a safety net when disasters strike.

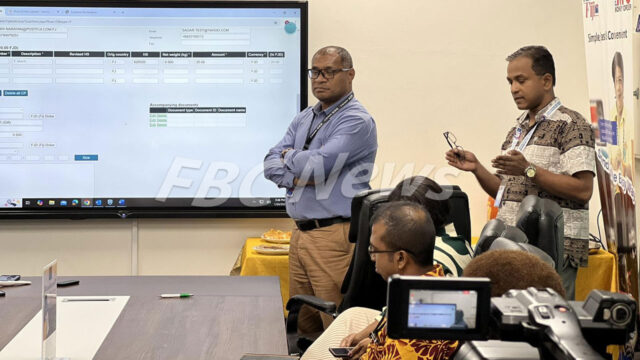

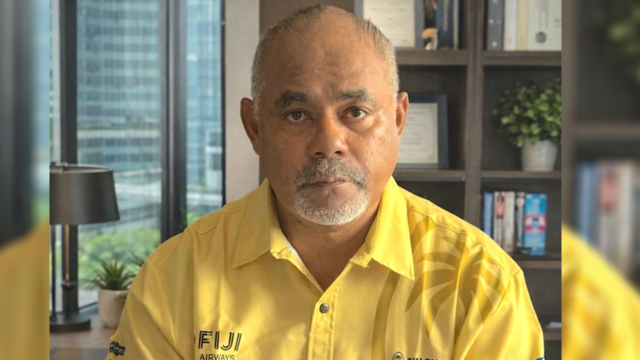

Permanent Secretary for Trade, Shaheen Ali, highlighted the urgent need for resilience as he launched a new partnership to provide climate and disaster insurance solutions for MSMEs.

The initiative, backed by the Asian Development Bank, the United Nations Development Programme, and the United Nations Capital Development Fund with support from the Reserve Bank of Fiji, aims to introduce parametric insurance products to help MSMEs recover faster from cyclones, floods and droughts.

Ali says MSMEs account for 80 percent of all registered businesses in Fiji, employ over 60 percent of the labour force, and contribute significantly to GDP.

“And before COVID-19, over 29,000 MSMEs were registered, contributing to $380 million in tax revenues. So these numbers are not just stats, they are faces and stories of Fijians everywhere.”

He stresses that while MSMEs form the backbone of Fiji’s economy, they remain the most vulnerable to climate shocks.

“They are forced to draw down on the little savings they have. Most of them don’t have savings, so they take on high-interest loans or shut their doors completely. The businesses that sustain Fiji are those that are most at risk of being knocked off course by weather conditions.”

The new partnership will see payouts triggered automatically when rainfall or wind thresholds are crossed, reducing delays and cutting bureaucracy.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Shania Shayal Prasad

Shania Shayal Prasad