Aerial shot of Suva City. [Photo Credit: Corona Today]

The Reserve Bank of Fiji, in its latest review, has stated that currently, risks to the economic outlook are driven mainly by external factors and tilted to the downside due to greater policy uncertainty, trade tensions, and softer global economic conditions.

On the upside, the RBF says lower imported prices, particularly for fuel, will be a positive externality to the trade war.

It says that domestically, the decline in visitor arrivals in the first quarter of 2025 has raised concerns about the outlook in the months ahead.

According to data received by the RBF, visitor arrivals recorded a second consecutive decline in March, aligning more with pre-pandemic monthly trends.

In the first quarter this year, total arrivals fell by 5.3 percent over the year to 180,119 visitors.

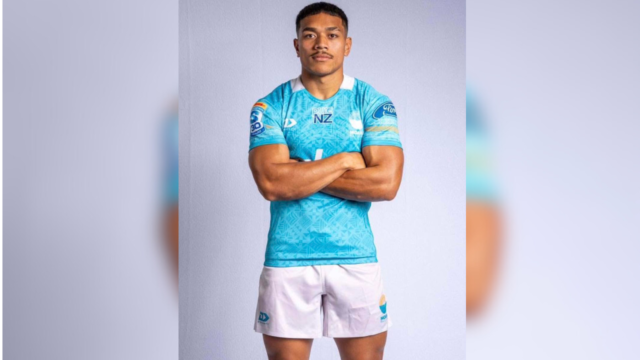

The dip was led by lower arrivals from key tourist markets Australia and New Zealand, which outweighed the increases from Pacific Island Countries and the US.

The RBF says in addition to the downward revision to world growth, the International Monetary Fund has also lowered Fiji’s growth forecast for this year from 3.4 percent to three percent initially and then further to 2.6 percent recently due to the tariff war.

This it says, is expected to spill over into 2026 as the outlook was downgraded from the pre-pandemic average of around 3.3 percent to 2.8 percent.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ritika Pratap

Ritika Pratap