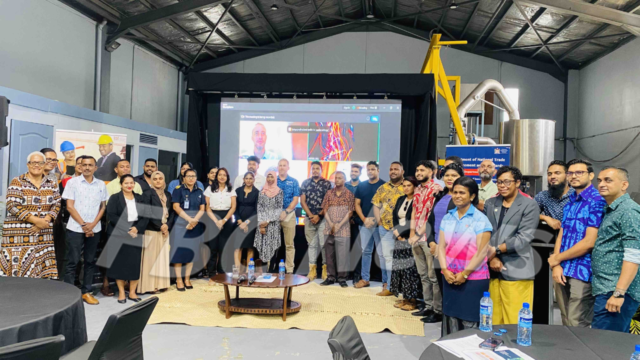

The Fiji Development Bank has launched an AI-assisted credit assessment tool designed to help small business owners secure loans, access finance, and attract more customers.

Speaking at the launch, FDB Chief Executive Officer Filimone Waqabaca says the pilot project marks the bank’s first step in testing and refining an AI-driven approach to deliver innovative financial solutions across sectors from agriculture and MSMEs to large commercial ventures.

He adds that through digital transformation and the development of technology strategies, the bank aims to improve turnaround times in the loan application process.

Waqabaca highlights that this initiative is closely aligned with FDB’s Strategic Plan, Fiji’s National Digital Strategy 2025–2030, and the Fiji National Development Plan all of which contribute to achieving the Sustainable Development Goals.

“A new era of artificial intelligence has dawned, prompted largely by various applications and tools that have now been made publicly accessible. Consequently, it presents an opportunity for FDB to take advantage of this new tide, increase operational efficiency, and facilitate improvements in our loan application process by using AI.”

Waqabaca says the pilot rollout for the AI-assisted credit assessment tool will be implemented in two phases.

He explains that Phase 1, launched today, will run for 12 months and focus on piloting the initiative with existing customers who have an established credit history with the bank.

Waqabaca adds Phase Two will build on lessons from the pilot and, once improved, will be expanded to new customers so more businesses across Fiji can access finance digitally.

He adds that the AI credit assessment tool will be accessible via the FDB mobile app and web platform, giving customers a faster and smarter way to have their loan applications preliminarily assessed.

By combining updated customer information with existing bank data, the tool delivers a seamless, data-driven experience designed for speed and convenience.

He further states that through the new app, the bank will assess loan applications of up to $100,000, including unsecured loans of up to $10,000 under the bank’s existing products, provided customers meet key eligibility requirements such as the minimum debt service coverage ratio.

Waqabaca also extended his gratitude to the Market Development Facility and Third Rock for their support in developing and implementing this innovative project.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Riya Mala

Riya Mala