[file photo]

The rollout of the VAT Monitoring System for businesses with an annual turnover of $50,000 or more is expected to be completed by January next year.

Fiji Revenue and Customs Services Chief Executive Udit Singh told the Standing Committee on Foreign Affairs and Defence that the initiative aims to improve transparency, prevent underreporting, and support the digitization of small and medium enterprises.

According to FRCS, since its introduction in 2017 and 2018, seven industries have already been using VMS, including supermarkets, pharmacies, hardware stores, travel agents, accountants, lawyers, and doctors.

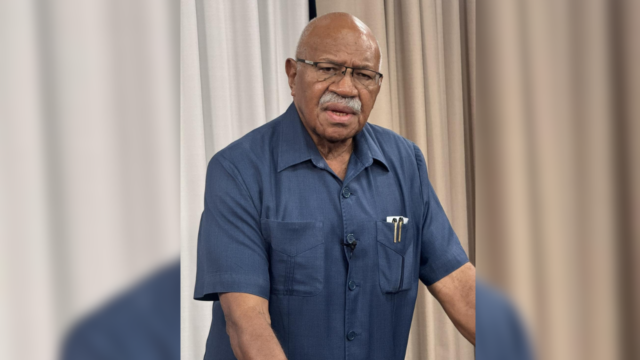

FRCS Chief Executive Udit Singh

FRCS Chief Executive Udit Singh the VMS implementation plan is already underway, with businesses expected to be fully compliant by January 2026.

“The thought process around this is that we were seeing a lot of taxpayers that were below the $100,000 threshold do everything in their means to stay below the threshold. And that means avoiding tax, not reporting. And so, we put that there for two reasons and secondly, to try and digitize that low end of the economy so we can get some more transparency.”

He adds that the cost of installing and maintaining VMS will be borne by individual businesses.

“The VMS cost will be borne effectively by the actual business. We are trying to put forward low cost POS systems. And some of them potentially up to $50 to $70 a month. We have also been advised there will be a dollar a day once as well.”

FRCS says the newly gazetted implementation schedule will bring real estate agencies, architects, and engineers on board in January 2026, followed by the accommodation sector with turnover under $5 million in March.

Larger hotels and accommodation providers will join in September, while wholesalers, distributors, and retailers are set to be included by December 2026.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Praneeta Prakash

Praneeta Prakash