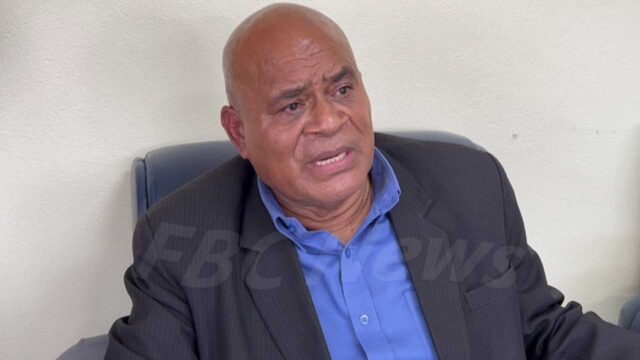

Finance Minister Esrom Immanuel during the launch of Fiji’s First AI Credit Assessment Pilot Project. He says the system will be closely monitored as data concerns were raised in Parliament [file photo]

The introduction of an AI-powered credit assessment system by the Fiji Development Bank has sparked concerns over data protection and regulatory oversight.

Finance Minister Esrom Immanuel told Parliament the system allows loan applicants to receive decisions in under 24 hours.

Immanuel assured strict monitoring through key performance indicators and said a full report will be provided after the pilot ends.

The Minister stated that the final decision always rests with experienced FDB officers who can override the AI with documented rationale.

“But the final decision always rests with our experienced officers who can override the tool with a documented rationale. This ensures FDB staff are empowered, not replaced.”

Opposition MP Faiyaz Koya asked if new laws have been introduced to cover AI-driven lending.

“So in that case, the question is, have you put in some new regulations because this is an entirely new platform and area that we are going to enter? Will there be more regulations or new regulations, or have you already put some in place.”

Assistant Minister Sakiusa Tubuna questioned how the system prevents data breaches or misuse by vendors and foreign servers.

“Given the system will process highly sensitive financial and personal data of Fijian citizens, can the Minister outline specific concrete measures in place to prevent data breaches and to ensure this information is not exploited by the vendor or hosted on insecure foreign servers.”

The AI system supports small businesses and financial inclusion, with the Minister emphasizing that human oversight keeps staff in control, empowering rather than replacing them.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Shania Shayal Prasad

Shania Shayal Prasad