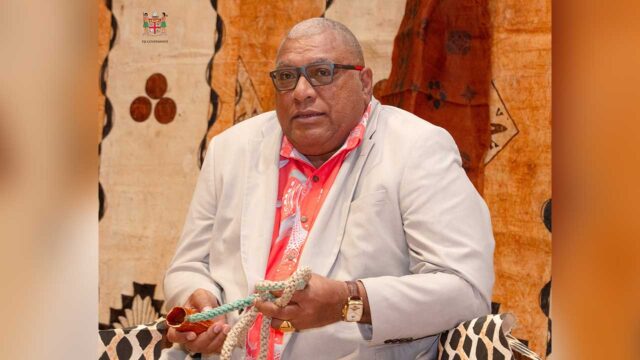

File Photo

The Fiji Revenue and Customs Service confirms that business individuals will now be required to declare M-PAiSA balances as part of their annual financial statements and asset declarations.

During submissions to the Standing Committee on Foreign Affairs and Defence, a member Rinesh Sharma questioned whether businesses receiving cash or payments through M-PAiSA will be required to include such transactions in their annual declarations.

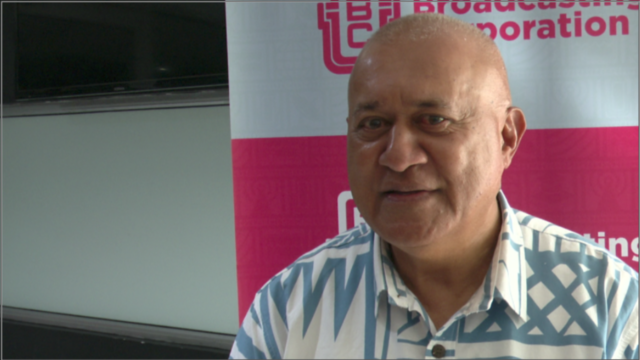

Responding to the question, FRCS Director Taxation, Momina Beg explained that all assets, including digital or mobile money holdings, must be declared as part of the taxpayer’s financial position.

“In respect to the declaration of assets, so, as at a particular date, usually for the business individuals will be 31st December. So, all the assets needs to be declared. And we are designing a form which will have some criteria for the assets that needs to be there. So, all the assets, especially in respect to cash at bank and M-PAiSA account, is also deemed as a cash at bank or money being held. So, that also needs to be declared.”

Beg adds that FRCS is currently working on a new declaration form that will provide clear guidelines for taxpayers to accurately report all forms of financial assets, including digital and electronic funds.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Praneeta Prakash

Praneeta Prakash