The Fiji Government has opened a Request for Proposal for the country’s first peer-to-peer lending platform, aimed at improving access to finance for micro, small and medium enterprises, including those in the informal sector.

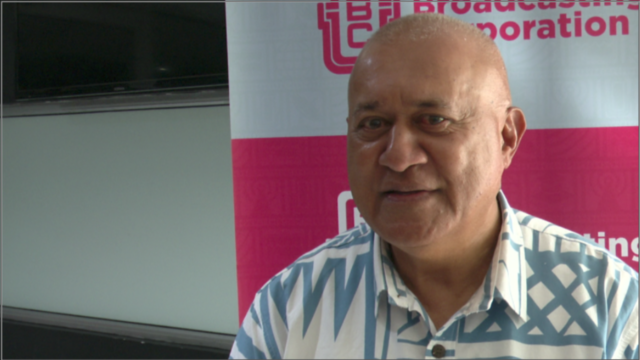

Minister for Finance, Commerce and Business Development, Esrom Immanuel, says the initiative moves Fiji from legislation to action following the Business Funding Act 2025, which came into force last December.

He says the platform will provide an alternative financing option through crowdfunding, targeting businesses that struggle to access traditional bank loans.

The project will be delivered through the Fiji Innovation Hub in partnership with the Reserve Bank of Fiji and other local and international partners, with the successful applicant receiving grant funding and technical support under a nine-week accelerator programme.

“This initiative is about unlocking opportunity that is giving Fiji’s MSMEs fair and equitable access to finance the need to start, grow and thrive.”

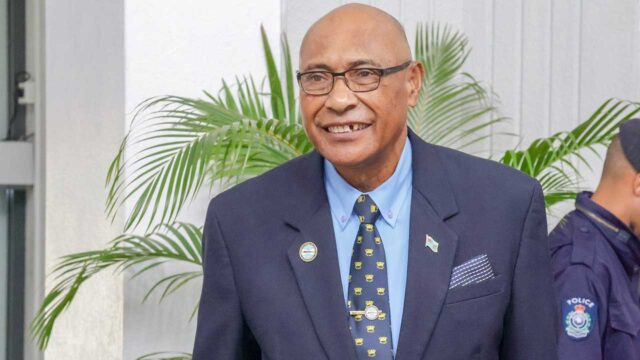

Reserve Bank Governor Ariff Ali says MSMEs contribute about 18 percent of Fiji’s GDP, with a national target to lift this to 40 percent by 2030.

He says peer-to-peer lending will complement the banking sector, broaden financial inclusion and support entrepreneurship and job creation.

The RFP opened today, will run for seven weeks and is expected to close in mid-March, with a decision due by 27 March.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Mosese Raqio

Mosese Raqio