Fiji faces a high risk of money laundering, driven by five primary crime threats: narcotics, organized crime, tax and customs offenses, environmental crimes, and bribery and corruption.

This was identified in a recent National Risk Assessment conducted to analyze Fiji’s exposure to money laundering, terrorist financing, and proliferation financing.

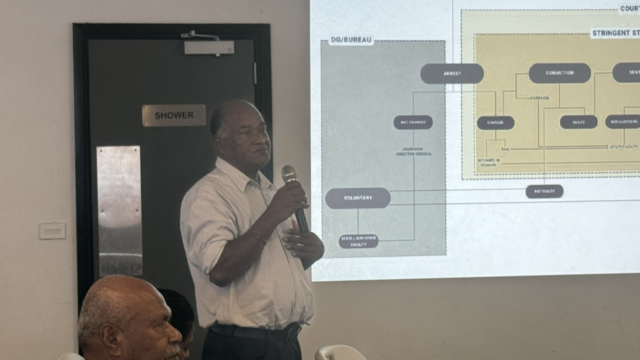

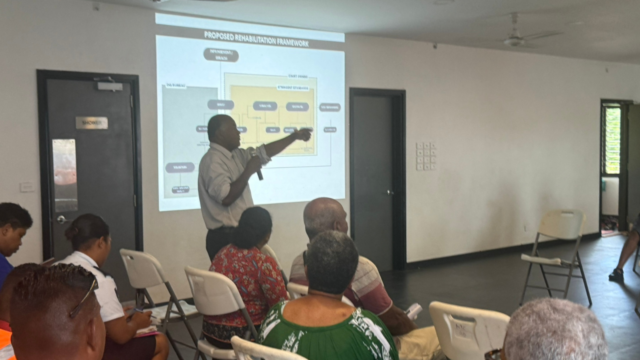

The report identifies vulnerabilities within the financial sector and assesses risks across 25 economic sectors.

National Anti-Money Laundering Council Chair, Selina Kuruleca, says commercial banks, foreign exchange dealers, payment service providers, legal practitioners, and real estate agents are highly vulnerable.

These sectors’ high transaction volumes, diverse customer profiles, and multiple products contribute to their risk levels.

Other business sectors were assessed as having medium to low vulnerability.

The NRA found Fiji’s overall terrorist financing risk to be low, citing a low-threat environment and effective institutional and legal controls.

Similarly, the risk of evasion regarding financial sanctions against North Korea and Iran—known as proliferation financing—is also rated low.

Ms. Kuruleca noted that the assessment is a significant step toward a stronger, more transparent financial system, providing law enforcement with a roadmap to target criminal threats and system weaknesses.

In response, the Council has updated national policies to mitigate these risks and will continue partnering with government, private, and civil society organizations to implement strategic priorities.

The assessment was conducted by the National AML Council, which includes the Permanent Secretary for Justice and the heads of the Reserve Bank, Police Force, Revenue and Customs Service, Financial Intelligence Unit, and the DPP.

Endorsed in late 2025, the report marks a milestone in Fiji’s commitment to international anti-money laundering standards set by the Financial Action Task Force.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Praneeta Prakash

Praneeta Prakash