Minister for Finance and Commerce, Esrom Immanuel, says Fiji is taking a bold step to improve access to finance for micro, small, and medium enterprises.

Speaking in Parliament this week, he highlighted the Access to Business Finance Act, passed in March, which introduces new funding options, including small offers, crowdfunding, and debt crowdfunding.

“These limits are safeguards to protect investors and uphold the integrity of the small offer mechanism to start with. Importantly, a small offer is not a government grant or a subsidy. It is an avenue that allows private companies to raise capital by offering shares to known parties or institutions, something never before available in Fiji.”

Esrom says these mechanisms allow private companies to raise capital from up to 48 investors, with safeguards in place to protect all parties.

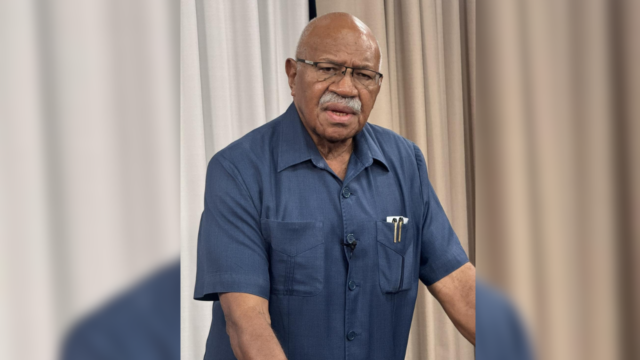

Esrom Immanuel [Source: Parliament of the Republic of Fiji/Facebook]

The initiative aims to break down barriers like a lack of collateral and geographic isolation.

A taskforce led by the Reserve Bank of Fiji, the Asian Development Bank, and the MSME Council is now finalizing regulations and preparing for phased implementation.

He says one example is Tokatoka Namara Limited in Nadi, which will use the new framework to expand its gravel extraction business on community-owned land.

The Minister says this reform will empower entrepreneurs, attract investment, and drive sustainable growth across Fiji.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Kelera Ditaiki

Kelera Ditaiki