[Source: Life Insurance Corporation of India - Fiji Operations]

The Life Insurance Corporation of India says the demand for life insurance is growing, but many families are still without basic financial protection.

General Manager Pradeep Shenoy says recent younger households in particular are showing greater interest in securing their financial future.

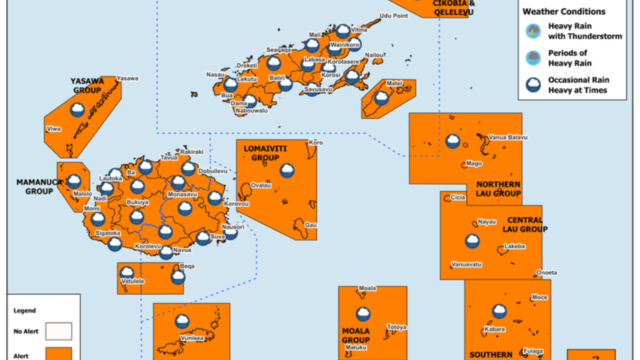

However, he adds that reaching rural and maritime communities, where awareness of insurance products is limited, remains a challenge.

Shenoy says insurance is no longer a luxury but a necessity, particularly as families grapple with inflation and health emergencies.

“People generally find it difficult to save after they receive the salary or their income. And then at the end of the month, if you ask them to pay a part of their salary, they find it very difficult to save. So, for LICI, our market is to the extent of 85% salaried individuals.”

Shenoy states that working with financial institutions and mobile platforms makes policies more accessible and affordable.

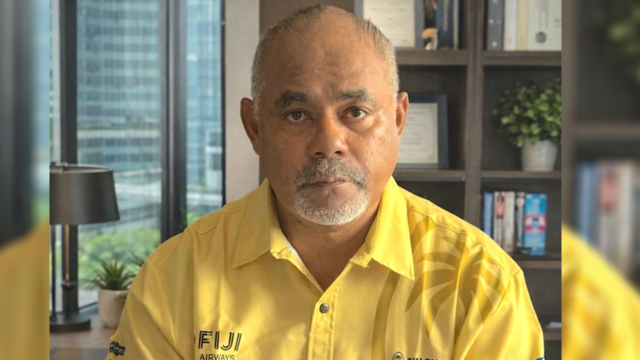

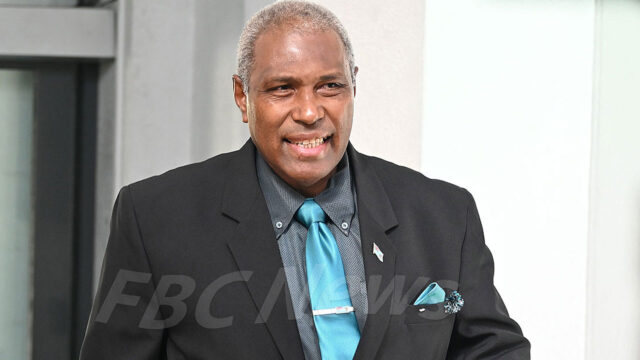

Reserve Bank of Fiji Governor Ariff Ali says insurance plays a critical role in channeling long-term investments into our economy.

“To meet the changing preferences of Fijian customers, who have become dynamic in their financial savings needs through increased disposable income, complemented by increased inflows through remittances and other sources of income.”

LICI states that the most demanded insurance areas include family protection, children’s education, and retirement savings.

They also launched two new products, the New Money Tree Plan and the New Gold Life Plus Plan, which aim to provide affordable long-term savings and family protection options.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Shania Shayal Prasad

Shania Shayal Prasad