[file photo]

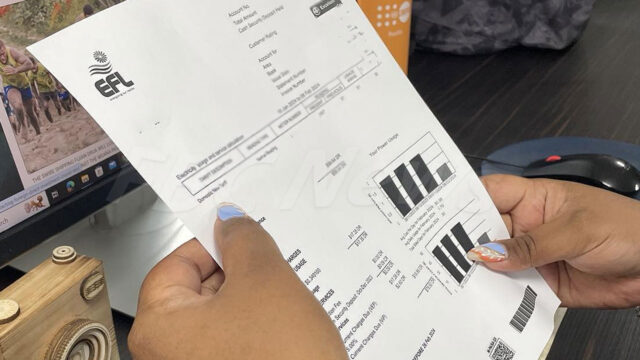

The Reserve Bank of Fiji States that consumption is rising sharply across the country but business investment remains sluggish.

In its June 2025 review, the Bank notes that increased wages, higher credit availability and a strong remittance flow are driving household spending.

New consumption loans rose by 52.8 percent in the first five months of the year to $995.1 million.

Most of this was directed to the wholesale, retail, hotel, and restaurant sectors. Inward remittances also grew by 14.4 percent to $580.3 million, with most received via mobile money platforms.

Vehicle registrations climbed 24.1 percent by May, driven by demand for both new and secondhand cars.

Net VAT collections were also up 8.1 percent due to stronger spending and compliance.

But new investment loans fell by 3.7 percent. Lending to the real estate sector dropped 14.5 percent and construction loans dipped 2.8 percent.

The Bank states regulatory delays and rising costs continue to hold back investor appetite, despite growing demand for construction materials and more building permits being issued.

The RBF notes that although indicators show some progress in building activity, broader investment growth remains uneven and could affect medium-term recovery.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava