The country has recorded a sharp rise in parametric insurance uptake as more families seek protection from severe weather.

Policyholder numbers have climbed from just over one thousand to more than four thousand this year.

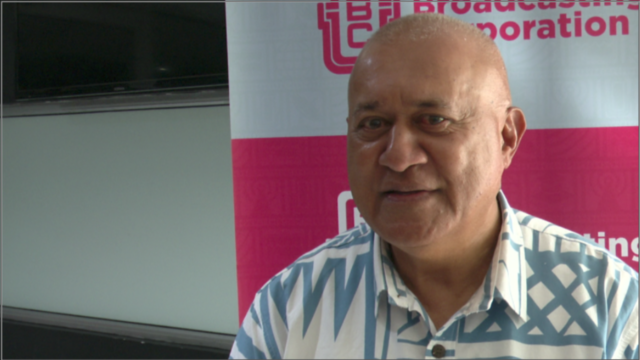

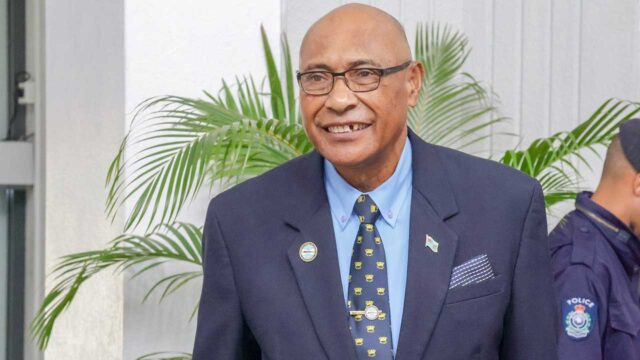

Finance Minister Esrom Immanuel says the programme has reached its strongest phase since it was introduced.

He adds the target for next year is ten thousand policyholders, supported by new options from local insurers.

“As a build up to this, SUN Insurance has recently launched its revised suite of products with a specific product covering social welfare recipients and persons with disabilities. Tower Insurance also launched a new standalone rainfall product, timely and relevant as we enter the wet and cyclone season.”

Immanuel says premiums remain within reach.

“The premiums are quite reasonable. For example, for farmers, sum insured of $1,000, the premium is $100; for sum insured of $2,000, the premium is $200. For welfare products, sum insured of $500, the premium is $50 per annum.”

The program is expected to boost resilience by providing quick and predictable payouts after disasters, easing pressure on emergency relief and helping households recover faster.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Shania Shayal Prasad

Shania Shayal Prasad