Certain meat suppliers are facing large retrospective VAT bills following a clarification to the Value Added Tax Act, with the government insisting the exemption for genuine producers has not changed.

In Parliament this week, Opposition MP Faiyaz Koya questioned why some suppliers were being charged hundreds of thousands of dollars in back taxes despite previously being treated as VAT-exempt.

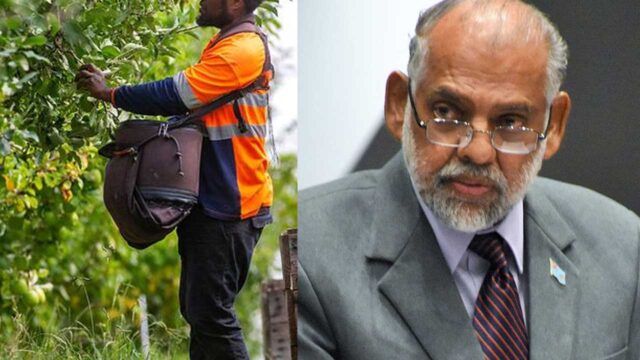

Minister for Finance Esrom Immanuel told Parliament the exemption continues to apply only to farmers, fishermen and those directly involved in meat, poultry and cattle farming.

“The amendment was necessary to make it clear that middlemen or resellers who buy produce from farmers and sell it on are not considered produce suppliers under the VAT Act.”

He said the August 1 amendment did not remove the exemption but clarified its scope to prevent misuse and ensure fairness.

Koya, however, urged the government to review the retrospective charges, saying some major suppliers now owe between $800,000 and $1 million.

He says these suppliers were given exemptions many years ago, and now they’re being told to pay VAT retrospectively.

Immanuel responded that the Act is supreme and businesses that disagree with FRCS assessments can seek redress through proper legal channels.

The Minister says only a few butcher meat suppliers have raised this issue as most others have already been compliant.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Mosese Raqio

Mosese Raqio