file photo

The country’s insurance industry hit record levels last year, posting $476 million in gross premiums and growing assets to $2.9 billion.

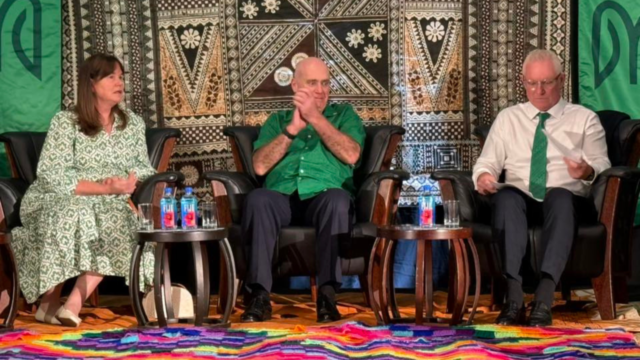

The Reserve Bank of Fiji released its 2024 Insurance Annual Report after it was tabled in Parliament by Deputy Prime Minister and Finance Minister Professor Professor Biman Prasad.

RBF Governor Ariff Ali said the industry remained strong despite rising claim costs and a tighter reinsurance market.

The sector’s solvency surplus climbed 22.6 per cent to $688.5 million.

Net claims and policy payments rose to $254.2 million. Life insurers paid $139.3 million, mainly for matured policies, while general insurers disbursed $114.9 million for medical and motor claims.

Ali states that the Reserve Bank is modernising its regulations, reviewing the Insurance Act 1998 and guiding insurers through the shift to IFRS 17 accounting standards.

The Governor outlined efforts to expand climate risk insurance. A grant from the InsuResilience Solutions Fund in August last year has enabled new and expanded parametric insurance products for households exposed to climate risks.

Ali warned that this year remains challenging.

Climate-related claims, global economic shocks and rising geopolitical risks could affect insurers.

He said the Reserve Bank was committed to keeping the sector strong, fostering innovation and ensuring insurance remains safe and inclusive.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava