The Fiji National Provident Fund has announced its strongest financial performance in history, generating more than $1 billion in investment income and declaring a crediting interest rate of 8.75 percent.

This is the highest in over 30 years.

The solid earnings pushed the Fund’s total assets to $12.1 billion, a major increase from $10.6 billion the previous financial year.

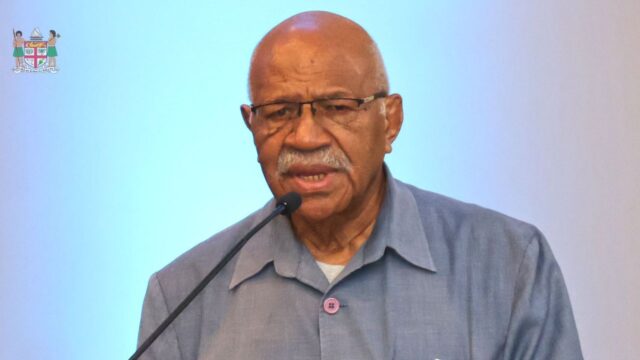

FNPF Chief Executive Officer Viliame Vodonaivalu says the record income reflects disciplined investment decisions and the Fund’s commitment to protecting and growing members’ retirement savings.

Vodonaivalu says the achievement shows FNPF’s strategic intent to grow sustainably while safeguarding members’ funds.

A total of $711.7 million was credited to members’ accounts on 30 June 2025.

Some of the key highlights include total contributions reaching $961.8 million, with net contributions of $444.1 million after withdrawals.

Additional contributions rose to $98 million, a 21% increase from last year and voluntary contributions hit a record $31 million.

The Fund continued to diversify across equities, bonds, commercial debt, and property. Major investments included new offshore placements worth $138 million in the S&P 500 ETF, IFC Emerging Asia Fund, BSP PNG, and Martin Currie Real Income Fund.

Vodonaivalu adds a significant milestone was FNPF’s partnership with Google to develop a new ICT facility at Natadola, a project expected to boost Fiji’s status as a regional technology hub.

The 2025 financial year also saw operational improvements, including lowering the membership age to birth, launching the first phase of a new customer management system, revising housing withdrawal policies to match rising homeownership costs.

FNPF also expanded retirement literacy programs, strengthened community outreach, and connected with Fijian members living in the US and UK.

The Fund acknowledged shifting member trends with migration withdrawals exceeded $82 million, and death-related withdrawals rose to a record $40 million, underscoring the need for stronger long-term retirement planning.

Vodonaivalu said FNPF remains focused on two priorities, they are strong returns and support when members need it most.

The Fund’s 2025 Annual Report was tabled in Parliament last Friday and will be presented during Member Forums early next year.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Apenisa Waqairadovu

Apenisa Waqairadovu