Aerial shot of Suva. [File Photo]

The Parliamentary Standing Committee on Economic Affairs has identified key areas to address gaps in Fiji’s insurance industry, including the need to modernise the 1998 Insurance Act.

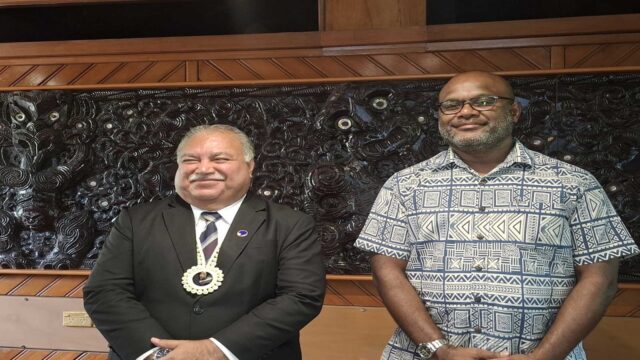

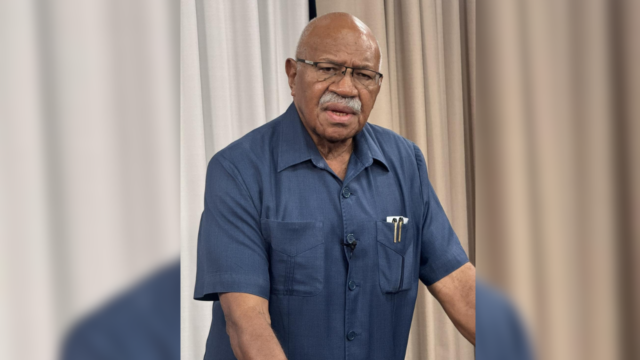

Assistant Minister in the Prime Minister’s Office, Sakiusa Tubuna, highlighted this while presenting the review report of the Reserve Bank of Fiji’s insurance report in parliament.

Tubuna says that although the industry has shown resilient growth following the COVID-19 pandemic, updating the Act is necessary to meet current needs.

These include addressing the increasing policy terminations due to surrenders and forfeitures, lower consumer awareness, and inadequate use of digital platforms to enhance insurance literacy.

“With total industry assets increasing from 2.3 billion in 2021 to 2.5 billion in 2022, representing 9% of the gross assets of the financial system.”

Tubuna also says the dual role of the Reserve Bank of Fiji as both regulator and complaints adjudicator which may compromise public confidence.

With the report now tabled for parliamentary deliberation, Tubuna expressed the committee’s optimism that this will lead to significant policy development aimed at reinforcing public trust in Fiji’s insurance industry.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Sainimili Magimagi

Sainimili Magimagi