Fiji’s investment landscape has undergone a significant transformation over the past decade, with growing capital flowing into various sectors signalling a shift away from the country’s traditional reliance on tourism and natural resources.

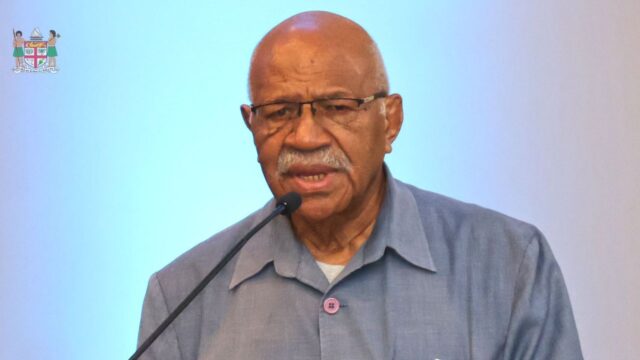

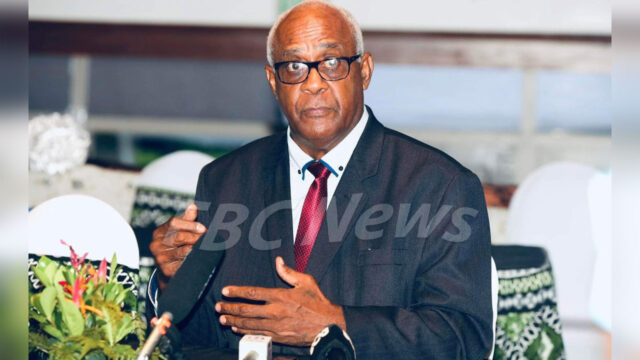

According to Investment Fiji Chief Executive Kamal Chetty, while tourism remains a major pillar of the economy, investor interest has become increasingly diversified, particularly in the years following the COVID-19 pandemic.

“Ten years ago, most investment was concentrated in resource-based sectors. Today, we’re seeing strong interest in renewable energy, technology, outsourcing, value addition and agriculture.”

He adds that the pandemic proved to be a turning point, reshaping global investment priorities and accelerating demand for digital services and sustainable industries.

Investment Fiji, says that as a result, sectors such as information technology, cyber security, artificial intelligence and business process outsourcing (BPO) have emerged as new areas of growth in Fiji.

Chetty notes that renewable energy has also gained traction, driven by global climate commitments and rising energy demand.

The Investment Fiji Chief adds that Agriculture, long viewed as a traditional sector, is also attracting renewed attention, particularly in value-added production aimed at supplying regional and international markets.

He highlights that domestic investors continue to play a critical role in this diversification.

Investment Fiji estimates that about 50 per cent of the investors it engages with are local, underscoring the importance of home-grown capital in driving economic activity.

Chetty states tourism investment itself is also evolving as visitor numbers have stabilised, new developments are increasingly focused on high-end and luxury offerings rather than mass-market expansion, adding another layer of diversification within the sector.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Nikhil Aiyush Kumar

Nikhil Aiyush Kumar