The Reserve Bank of Fiji’s inaugural Gender Inclusive Finance Report, reveals ongoing barriers that limit women’s access to formal financial services, despite recent progress in inclusion rates.

Launched this month, the report identifies several key challenges facing women in the financial sector.

These include underrepresentation in financial services, limited financial literacy, and lack of sex-disaggregated data on women-owned businesses.

Women also face structural and regulatory constraints that disproportionately affect their economic participation.

Developed in collaboration with the Fletcher Leadership Program for Financial Inclusion at Tufts University and the Asian Development Bank’s Pacific Private Sector Development Initiative, the report draws insights from a survey of 18 financial institutions, service providers, and government agencies.

The report highlights that while savings account ownership among women has improved, access to credit remains significantly lower, with loan accounts for female clients still nearly half those of male counterparts.

According to the report, female account ownership rose from 52 percent in 2014 to 82 percent in 2022, reducing the gender gap from 16% to 10% and among female youths, ownership increased from 59 percent to 65 percent.

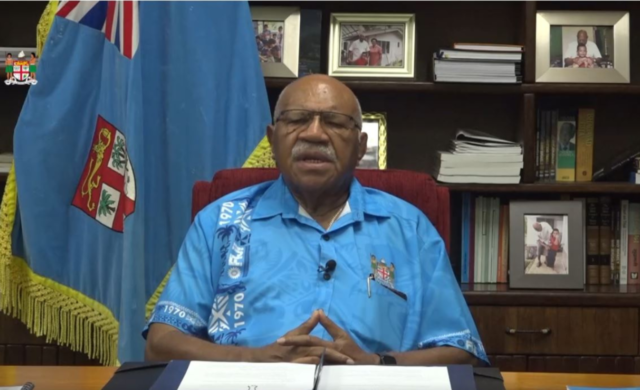

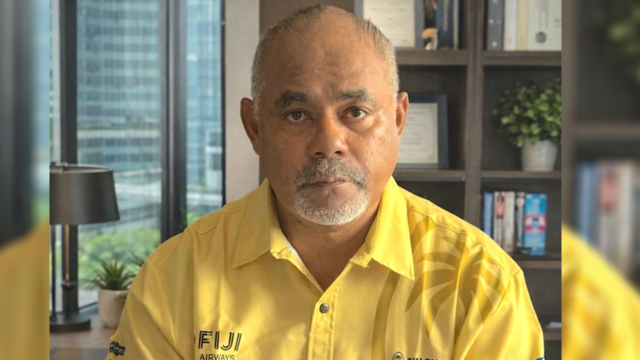

RBF Governor Ariff Ali says the report is not just a publication but a call to action, stressing the importance of collective efforts to close the financial inclusion gap in the country.

Governor Ali says gender-inclusive finance is indeed central to their national development goals.

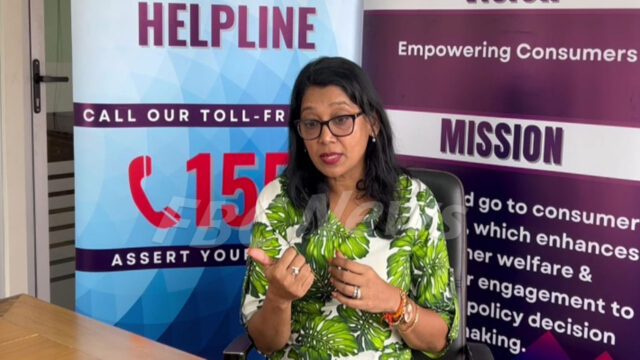

Permanent Secretary for Women, Eseta Nadakuitavuki, says the report will serve as a critical tool to guide reforms and innovation, aligning closely with Fiji’s National Development Policy to ensure no one is left behind.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Josefa Sigavolavola

Josefa Sigavolavola