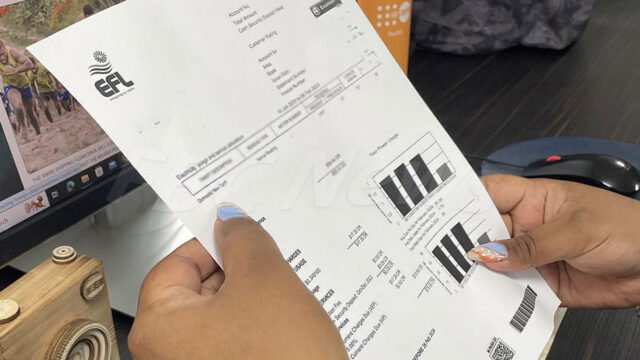

The Ministry of Finance is encouraging financial institutions to venture into the use of Artificial Intelligence to help micro, small, and medium businesses grow.

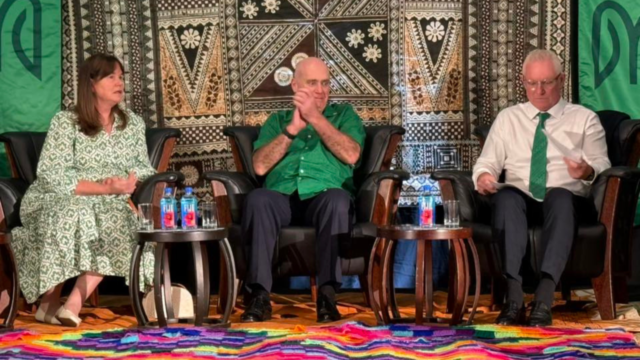

Minister Esrom Immanuel thanked the Fiji Development Bank for launching its AI-assisted credit assessment tool, which will help small business owners get loans, access finance, and reach more customers.

He also acknowledged that many people are not familiar with using such technology, but assured that guidance and support will be provided to help them use it effectively.

Immanuel emphasised that embracing AI is an important step in modernising the financial system and creating opportunities for businesses across Fiji.

“For instance, FDB, that’s their task. They have to bring the service down to that level. Teach them, as you’ve probably seen in the video. The customers or potential customers do not need to come to the office. So that is for FDB and also other financial institutions to go down to that level.”

Immanuel assures people that these advances are safe, despite the disadvantages associated with AI, highlighting that banks have a stronger IT infrastructure to support them.

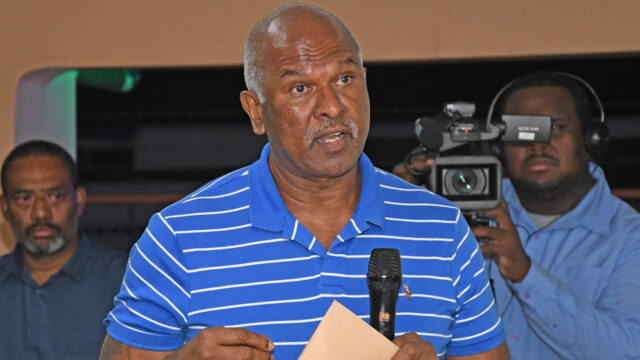

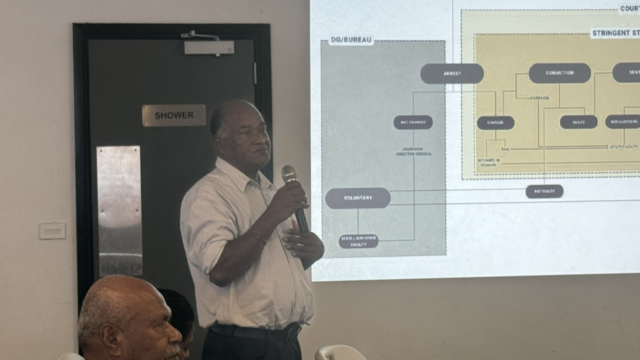

FDB Executive Filimone Waqabaca says Fiji should use technology to build a stronger economy. The new AI credit tool helps FDB support these national plans.

“A new era of artificial intelligence has dawned, prompted largely by various applications and tools that have seemingly been made publicly accessible.”

Waqabaca adds that with these initiatives, more people will be encouraged to start their businesses, knowing that the required support is available to help them expand.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Riya Mala

Riya Mala