Companies are increasingly reluctant to list publicly, citing past failures and the pressure to deliver short-term results at the expense of long-term goals.

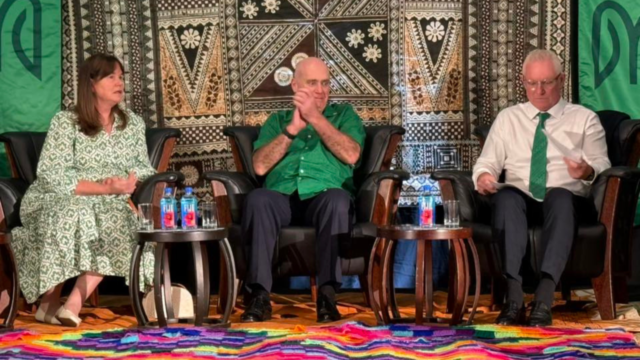

South Pacific Stock Exchange Chair, Nitin Gandhi, says fear of the public market remains a major barrier, with many firms choosing to stay private longer to avoid the scrutiny and risks associated with public listing.

Gandhi explains that this fear, along with high compliance costs and strict regulations, has led some companies to explore other options or face difficulties after listing.

“And while you want to have a tightly controlled business, the majority of businesses are tightly controlled. They don’t really want to expose themselves to the market. That view is changing now more than ever.”

He encourages businesses by pointing out that while some companies have faced challenges, many others have had successful experiences going public.

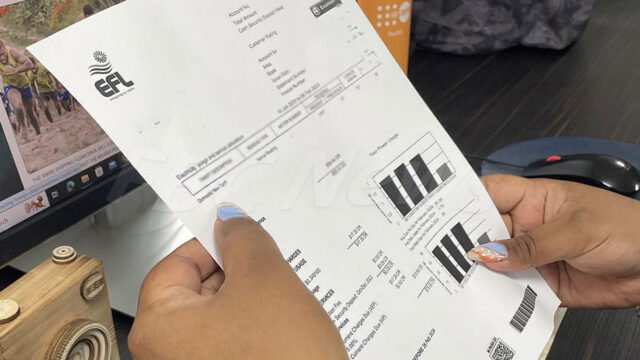

Partner at BDO Fiji, Nalin Patel, highlights that past initiatives struggled due to tax uncertainty.

“So I think that was one factor, among others. But fast forward to today, the binding ruling is a great thing. If there’s any doubt, you can actually get a private binding ruling to make it absolutely clear so that someone waking up the next day doesn’t interpret that section differently.”

He adds that clear tax rules, more open policies, and consistent regulations now give businesses the confidence and stability to consider going public and making long-term investments.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Riya Mala

Riya Mala