[File Photo]

An assessment conducted by the Asian Development Bank’s Women’s Finance Exchange notes that women-owned Micro Small and Medium Enterprises, which accounts for 19 percent of the MSMEs in Fiji, have an unmet credit demand of around $250 million.

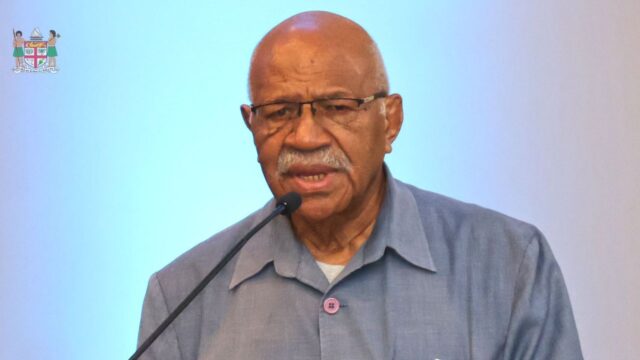

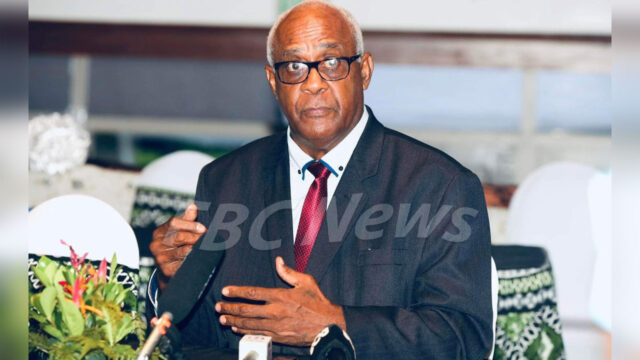

ADB Pacific Subregional Office Regional Director Aaron Batten says the credit gap comprises an unmet demand for formal credit of around $169 million and a potential demand of approximately $81 million from the informal sector.

Battern says while there are commendable credit initiatives that target women, there is plenty of room for private sector financial institutions to take a strategic and gender-intelligent approach to serve women entrepreneurs.

He adds that the report reveals a large untapped opportunity for financial institutions in Fiji to expand their support for businesses owned and run by women in ways that benefit the wider economy.

Battern says the assessment looks at the MSME landscape in Fiji, including the barriers faced by women entrepreneurs, and the business case for financial institutions in addressing these barriers. It offers several recommendations for the financial inclusion of women entrepreneurs.

It recommends financial institutions should consider women’s smaller sales turnover when segmenting MSMEs to ensure inclusion; collect sex-disaggregated MSME data to guide business cases and decisions, identify key performance indicators to understand and serve the customer better, and conduct market research to understand the barriers WMSMEs face in accessing finance.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Kreetika Kumar

Kreetika Kumar