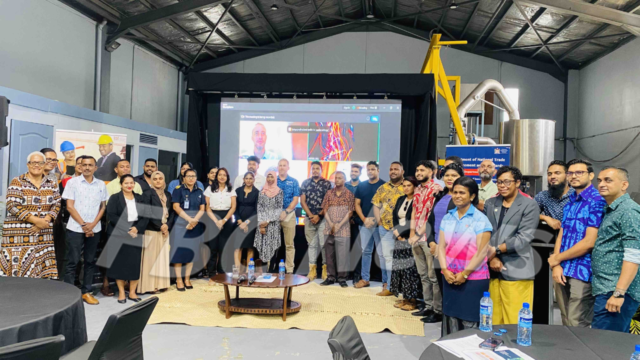

Fiji Revenue and Customs Service Chief Executive Udit Singh. [Photo: SUPPLIED]

Fiji Revenue and Customs Service Chief Executive Udit Singh has acknowledged that Fiji failed to act when first warned by the European Union in 2017, a failure that ultimately led to the country being blacklisted in 2019.

Singh says Fiji was given 12 months to respond to concerns raised by the EU, particularly around tax transparency and harmful tax practices, but did not make the required changes at the time.

“I think the fact remains that we did not respond. We did not respond to the request from the EU to make those changes. They gave us a 12-month period to come forward with a response, and at the time, for whatever reason, we did not”

Singh also admitted there was a lack of appetite to implement reforms during that period.

Fiji was subsequently placed on the EU’s list of non-cooperative jurisdictions for tax purposes, a move that carried reputational risks and potential financial consequences.

Singh says in the last three to four years, there has been renewed direction from government and the FRCS board to address the issue and secure Fiji’s removal from the blacklist.

Being removed from the list means Fiji is now recognised as meeting international tax governance and transparency standards.

It reduces the risk of enhanced scrutiny on financial transactions involving Fiji, improves confidence among foreign investors, and strengthens the country’s standing in trade and international financial cooperation.

The blacklist had raised concerns among development partners and global investors, as EU-listed jurisdictions can face tighter due diligence requirements and reputational damage.

With Fiji now off the list, officials say the focus is on maintaining compliance to ensure the country does not return to heightened monitoring.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Apenisa Waqairadovu

Apenisa Waqairadovu