[file photo]

The government has introduced a new fiscal plan aimed at tackling two major challenges.

They are improving tax compliance in the digital era and easing the financial burden on households.

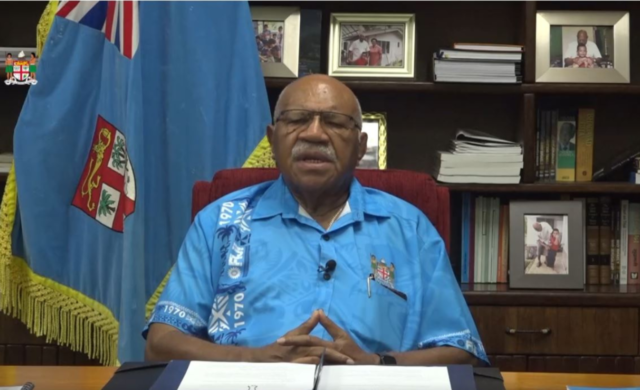

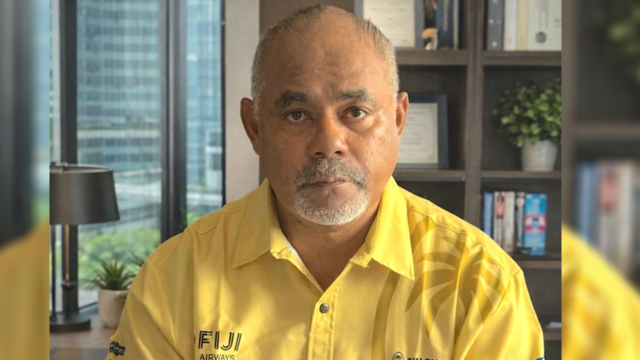

Deputy Prime Minister and Minister for Finance, Professor Biman Prasad, presented amendments to 15 bills in Parliament, including the Tax Administration Bill, as part of sweeping reforms to modernize Fiji’s tax system.

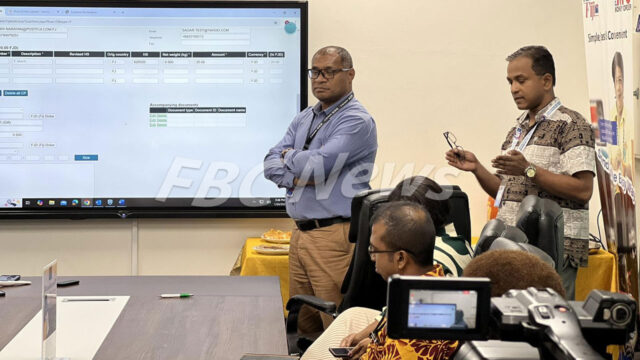

Professor Prasad says key measures include mandatory e-wallet regulations for businesses, annual asset declarations for sole traders, and ongoing education for tax agents.

“It introduces a separate e-wallet for business, annual asset declaration for sole traders, and TIN requirements for e-wallets. This is a very significant step in ensuring that we address the cost of living in a holistic manner.”

He says stronger audit powers and better international cooperation will help the Fiji Revenue and Customs Service track under-reported income and meet global tax standards, reinforcing Fiji’s commitment to financial integrity.

The reforms are part of a broader strategy to improve compliance, adapt to digital finance trends, and ensure that the benefits flow directly to ordinary Fijians through better services and reduced living costs.

Parliament has passed the Tax Administration Bill, Income Tax Bill, Value Added Tax Bill, and the Customs Budget Amendment Bill today.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Sainiani Boila

Sainiani Boila