The government has introduced key reforms to the Banking Act of 1995, aiming to modernize the dissemination of unclaimed money information and improve public access through digital means.

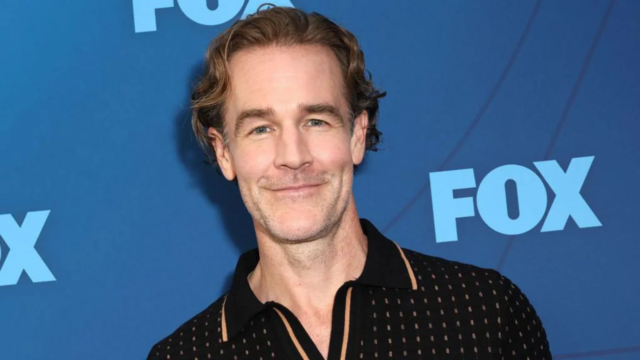

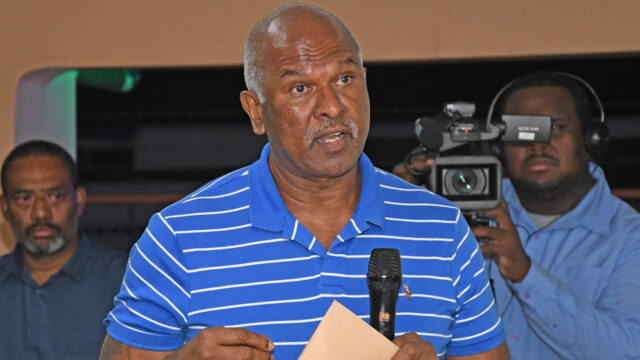

Presented by the Minister for Finance, Professor Biman Prasad, the Banking Amendment Bill seeks to align the banking regulations with technological advancements and evolving consumer habits.

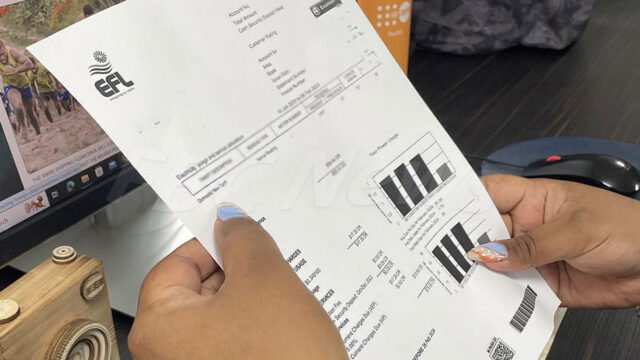

Under the proposed amendments, licensed financial institutions will now be required to publish lists of unclaimed money on their official websites instead of the current practice of releasing lengthy notices sometimes spanning multiple pages in print media.

“We are trying to move away from that so the amendment alos require licensed financial institutions to provide instructions as to how the list may be accessed which will be notified to members of the public through a gazette.”

Prof. Prasad says the lists cannot be removed from the website of any licensed financial institution without the prior approval of the Reserve Bank of Fiji, reinforcing oversight and safeguarding public interest.

“These changes are administrative in nature and reflect the rapid adoption of technology by Fiji’s commercial banks, keeping pace with global trends and the widespread use of digital media by the general public.”

In addition to the Banking Act amendments, the Finance Minister also addressed proposed changes to the Credit Reporting Act.

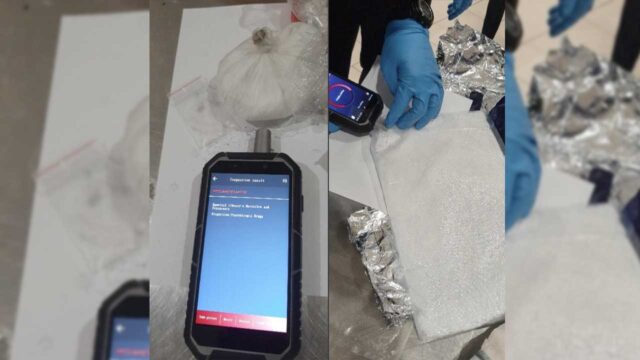

The new measure will empower credit reporting agencies to incorporate more extensive information on individuals and companies.

Public data on matters such as bankruptcy and insolvency will now be allowed in agency databases, a move intended to bolster the accuracy and reliability of credit checks.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Sainiani Boila

Sainiani Boila