The government is confident that planned tax cuts and wage increases will boost household spending and help support national revenue in the 2025/26 financial year.

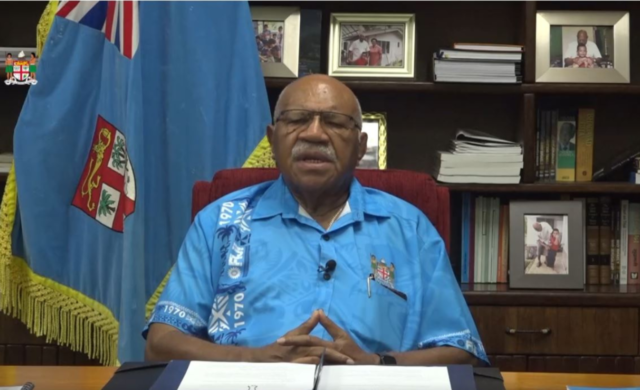

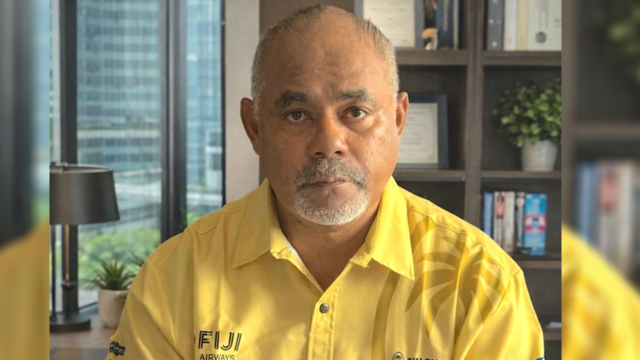

Deputy Prime Minister and Finance Minister Professor Biman Prasad says despite a slight drop in tax collections, the total revenue is projected at $3.95 billion.

From August 1, VAT will be reduced from 15 percent to 12.5 percent, and civil servants will also receive salary increases.

While tax revenue is expected to fall slightly due to the VAT reduction, the finance minister says the broader economy will benefit from these measures.

“Had we retained the existing VAT and tax structure, our tax revenues would have increased by an estimated $180–$200 million, solely due to economic growth. This clearly illustrates that the decline is not due to weak economic performance but rather due to conscious, pro-people policy reforms.”

Professor Prasad says the government also expects a record $1.4 billion in remittances next year, which will give families even more spending power.

“Remittance inflows are projected to reach a record $1.4 billion in 2025, further strengthening household spending power. Mr. Speaker, Sir, while tax revenues may dip slightly, this will be offset by a strong increase in non-tax revenues, which are projected to rise.”

Assistant Finance Minister Esrom Immanuel says the budget reflects the government’s ongoing commitment to fiscal responsibility.

While we project a fiscal deficit of 6 percent of GDP, this is carefully calibrated in response to current economic and social pressures and designed to provide targeted support to families, protect essential services, and drive infrastructure growth.

Non-tax revenue is expected to rise by $57.6 million. This includes more from fees, fines, and charges, as well as cash grants from development partners and dividends from state-owned enterprises and the Reserve Bank of Fiji.

The budget was passed this week.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Praneeta Prakash

Praneeta Prakash