Each year, the black economy is estimated to cost Fiji nearly a billion dollars in lost tax revenue.

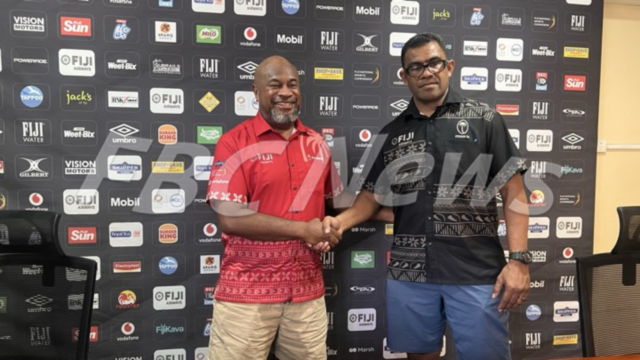

This was revealed by Fiji Revenue and Customs Service Chief Executive Officer Udit Singh, who says a large portion of economic activity is happening outside the formal tax system.

He adds that from unlicensed businesses to individuals avoiding tax, the black economy continues to grow largely unchecked.

Singh says too much money is moving outside the system without receipts, records, or accountability.

He adds that the impact is massive and is slowing down economic progress.

“A lot of this money moves around, and we are trying very hard to make sure that those in the black economy become willing to comply. We want voluntary compliance, and that’s what we’re trying to encourage. There’s a huge effect on economic growth, even though this money does circulate and create a multiplier effect.”

Singh says they are working to bring these operators into the formal economy through digital solutions such as QR codes and M-PAiSA payments.

Assistant Minister for Finance, Esrom Immanuel, says new systems are now in place to help the FRCS to monitor suspicious activity and track non-compliant businesses.

“There are some that are still out there, and FRCS has done some work in this regard. They now have strategies in place to investigate at those levels.”

He adds that the black economy is costing Fiji valuable economic growth, and the real challenge now is ensuring that everyone follows the rules.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Riya Mala

Riya Mala