Good news for business operators and aspiring entrepreneurs as there have been business-friendly measures announced to assist Fijians impacted by COVID-19.

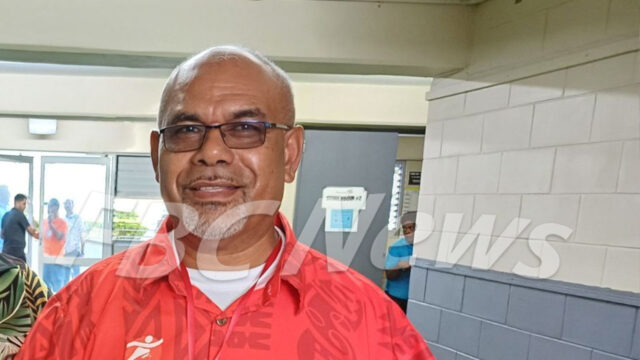

Minister for Economy Aiyaz Sayed-Khaiyum announced that from the 1 August 2020 will mark the end of Fiji’s business license regime.

“To start a business in the next financial year, you can complete an easy, online business incorporation and tax registration, then you’re in business it’s that simple. There’s no longer a need to fork out the money or the time it takes to obtain a business license.”

Sayed-Khaiyum also highlighted that some of the business-friendly measures announced in the COVID Response budget have been extended.

Sayed-Khaiyum announced that the payment of advanced corporate taxes is now permanent.

Sayed-Khaiyum has also highlighted that the implementation of the Vat Monitoring System will be extended until the 1st of January 2022.

He adds that the debt forgiveness provision will be extended to 31st December 2021 to grant businesses another full calendar year of flexibility.

Following the suspension of the thin capitalization rule to 31st December 2020, Syed-Khaiyum has announced that the thin capitalization ratio will now permanently increase to three is to one.

“Residential rents regardless of turnover are now VAT exempt and the government is removing the VAT reverse charge on supplies received from abroad. The depreciation writes off incentive for fixed assets of up to $10,000 is now permanent. As will be the 100 percent write off for the construction of commercial industrial buildings. So there is no need to seek provision approval by years end.”

Sayed-Khaiyum also revealed that the provision allowing landlords to claim a tax deduction on the sum for any reductions made of commercial rents will be extended an additional year, to 31 December 2021.

He adds that the reduction of mandatory employer and employee contributions to 5 percent will be extended through to 31 December 2021.

The Minister for Economy also highlighted that all employers who go beyond the call of duty and contribute more than 5 percent up to 10 percent will be given a generous 150 percent tax deduction backdated to 1st April 2020.

He says this additional contribution will be exempt from taxes for employees also adding that to further incentivize employers to go the extra mile for their employees’ government is making fringe benefits offered by employers’ tax-exempt.

2020/2021 National Budget Address

2020/2021 National Budget Address

Posted by FBC News on Thursday, 16 July 2020

Members of parliament are seen heading into parliament for the 2020-2021 Fijian National Budget announcement. #FBCNews #FijiNews #Fiji #FJBudget

Posted by FBC News on Friday, 17 July 2020

Lena Reece

Lena Reece