[Source: Reuters]

The dollar was on the front foot on Monday, supported by a strong run of economic data out of the United States that traders bet will keep the Federal Reserve on its monetary policy tightening path for longer than initially expected.

The greenback advanced broadly in early Asia trade, sending sterling 0.12% lower to $1.2028 and the Aussie falling 0.18% to $0.6866.

Against the Japanese yen , the dollar rose 0.14% to 134.32.

Trading is likely to be thin on Monday, with U.S. markets closed for Presidents’ Day.

A slew of data out of the world’s largest economy in recent weeks pointing to a still-tight labor market, sticky inflation, robust retail sales growth and higher monthly producer prices, have raised market expectations that the U.S. central bank has more to do in taming inflation, and that interest rates would have to go higher.

“For the week ahead, the dollar can track higher given the recent run of economic data which supports the narrative of higher-for-longer interest rates,” said Carol Kong, a currency strategist at Commonwealth Bank of Australia (CBA).

Markets are now expecting the Fed funds rate to peak just under 5.3% by July.

Hawkish comments from Fed officials have also underpinned the U.S. dollar, as they signaled that interest rates will need to go higher in order to successfully quash inflation.

Similarly, two European Central Bank (ECB) policymakers said on Friday that interest rates in the euro zone still have some way to rise, pushing up market pricing for the peak ECB rate.

That, however, did little to lift the euro , which was last 0.16% lower at $1.0677.

Elsewhere, the U.S. dollar index rose 0.05% to 104.03, and is up nearly 2% for the month so far, keeping it on track for its first monthly gain since last September.

The kiwi slipped 0.17% to $0.6232, with eyes on the Reserve Bank of New Zealand’s (RBNZ) interest rate decision on Wednesday.

The RBNZ is expected to scale down its tightening campaign only slightly, with a half-point interest rate hike to 4.75%.

In Asia, focus is on China’s loan prime rate decision on Monday, with markets widely expecting its benchmark lending rates to be kept unchanged at the monthly fixing.

The offshore yuan was last marginally lower at 6.8783 per dollar.

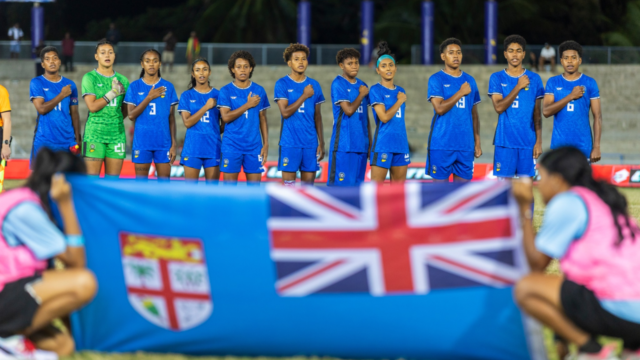

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Reuters

Reuters