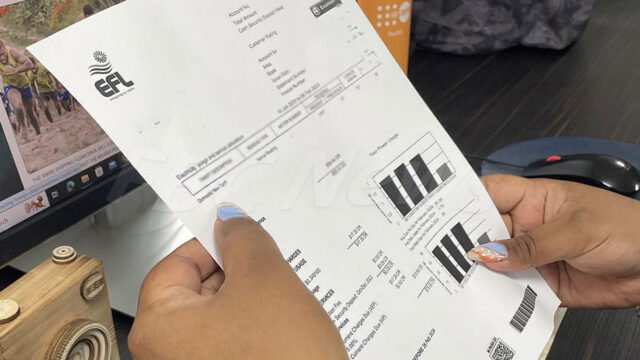

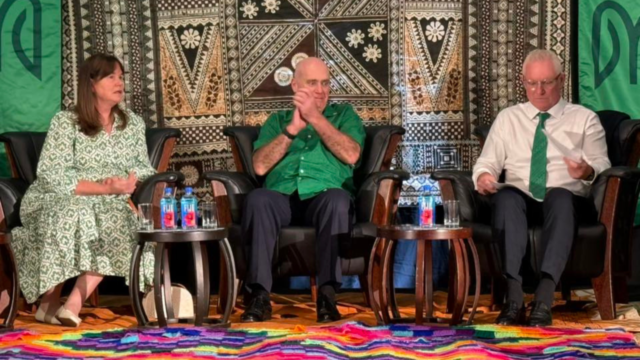

The Fiji Revenue and Customs Service is currently working with the taxpayers as they look into the current Taxpayer online system.

Outgoing Chief Executive Mark Dixon says this is to help improve the system and, at the same time, make the Tax Administration more efficient about increasing revenue.

Dixon says according to the 2023–2024 national budget, the government is committing more money to health, education, and infrastructure like water, so the FRCS will help the government find the revenue to do that.

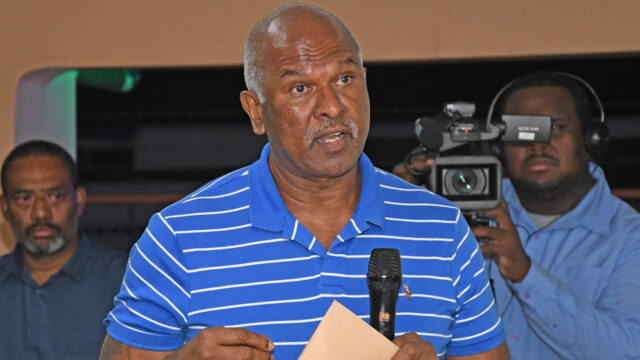

“So there was a target in terms of how we had to grow Fiji’s revenue, and that’s, of course, why the VAT has gone up because the biggest lever we can pull to get additional revenue is VAT; it’s across the board.

The outgoing CEO says the increase in VAT by 15 percent and the corporate income tax rate will allow additional revenue collection that Fiji needs.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Sainiani Boila

Sainiani Boila