[file photo]

To significantly enhance tax administration and boost revenue transparency, the Fiji Revenue and Customs Service is set to introduce a new VAT Monitoring System.

This system will be mandatory for all businesses with an annual turnover of $50,000 or more.

The implementation will occur in phases, with the system officially coming into effect on January 1st.

FRCS Director of Corporate Services, Shavindra Nath, states that the VMS aims to modernize VAT compliance and improve revenue transparency, while simultaneously working to reduce tax evasion.

The new change also complements the 2025-26 national budget, especially the tax reforms.

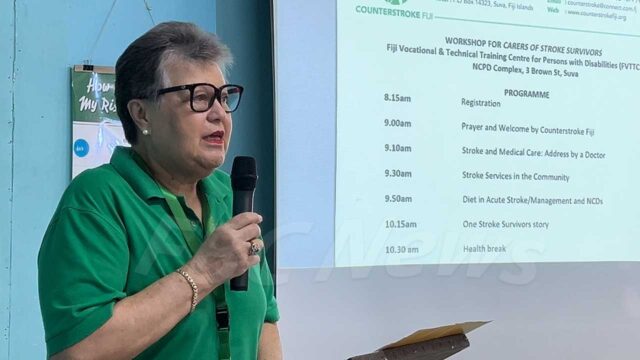

Meanwhile, Deputy Prime Minister and Minister for Finance, Professor Biman Prasad is urging all Fijians to invest and grow Fiji’s economy.

The national budget also reflects coalition government’s support towards Fijian Diaspora boosting their financial activity in the country.

“So we’re trying to do as much as we can to make it easier for our people to come back, leave, decide, and invest in Fiji. So that change, the expected change, plus the change that I also announced in terms of the fees for citizenship, we reduced it from $3,450 to $1,500.”

To support our Fijian diaspora, the government will also make changes to the Income Tax Act to allow citizens residing overseas to reorganise and protect their Fiji-based assets through the use of properly structured resident Family Trusts.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Sainimili Magimagi

Sainimili Magimagi