The implementation of the VAT Monitoring System (VMS) has assisted two business taxpayers detect fraud in their business.

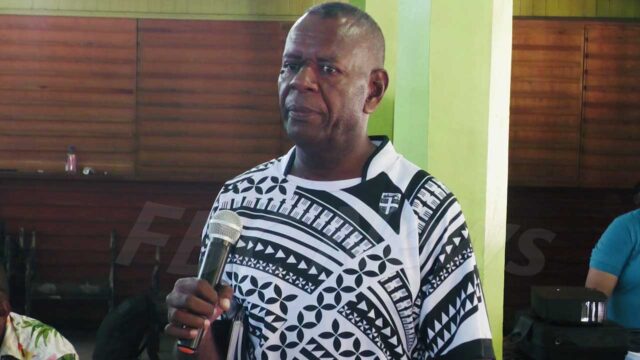

Fiji Revenue and Customs Service chief executive, Visvanath Das made the revelations during the CEO’s Forum which was held earlier this week.

Das says, the Customs Service received feedback from two groups of taxpayers saying that implementing the system in their business enabled them to detect fraud since everything is fiscalised and goes through point of sales systems.

The fraud they detected was around $10,000 – $15,000.

Das says the compliance level for the implementation of the system has increased.

He says the VMS Phase 1 compliance rate has increased to 60 percent for supermarkets and pharmacies and the Phase 2 for Accountants, Lawyers, Medical Practitioners and Hardware businesses has a compliance rate of about 80 percent.

Others, Das says are to voluntarily comply by the end of next month after which fines and penalties will be instituted.

He adds that under the VAT Monitoring System, Phase 1 and 2 industries need to issue proper fiscal invoices and customers can report business that do not do so to the FRCS.