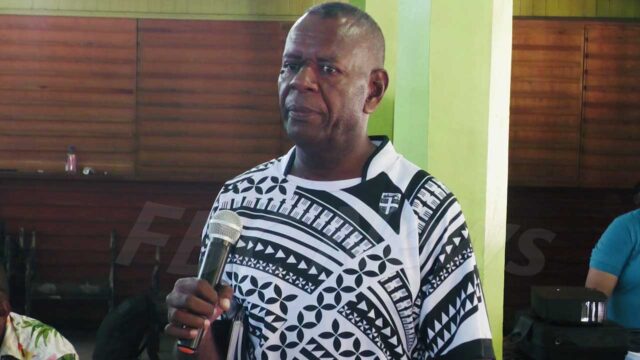

Minister for Commerce Faiyaz Koya says the Opposition should not project the $80 million increase in guarantees for the Fiji Development Bank as a sinister motive.

Koya says this is the government investing in the future of the nation.

Attorney-General, Aiyaz Sayed-Khaiyum, today moved a motion to approve the increased in government guarantee for FDB from $170 million to $250 million.

This is for a 12-month period from 1st March 2021 to 28th February 2022 through the issuance of short and long-term bonds, promissory notes, term deposits, other short term borrowings and any Reserve Bank of Fiji financing facility.

Sayed-Khaiyum says the government guarantee will ensure that FDB continues to assist the Micro, Small, and Medium Enterprises.

“The bank has forecast a total of $100 million outlay under the COVID- 19 guarantee scheme as of 20th February 2022, the banks total outlay forecast at 20th February 2022amounts to $397.7 million. The bank’s total inflow forecast for 2021 amounts to 147.7 million dollars which indicates that an additional 80 million dollars is required to finance the total outlay of $397.7 million. This will cater for the scheme as the existing government guarantee scheme of $170 m is not sufficient to cover the new borrowings under the scheme.”

Opposition MP Niko Nawaikula opposed the motion.

“There are also very serious questions about this bank and we had pointed out before that it has shifted away from its core role.”

Trade Minister Faiyaz Koya says the bank continues to play a pivotal role in the development of the Fijian economy.

“This support will most definitely boost the FDB to assist more MSMEs to bounce back and navigate through this new norm that we have and I want to remind the opposition that FDB is operating at a very high standard which any institution is meant to operate when serving the Fijian people.”

As of 14th September FDB has approved 3, 263 loans with a value of $50.9 million.

Another 8, 114 applications worth $139.1 million are being processed.

Praneeta Prakash

Praneeta Prakash