If the government had paid the taxes for the former Supervisor of Elections, then the tax refund should have gone to the government, which bore the tax burden.

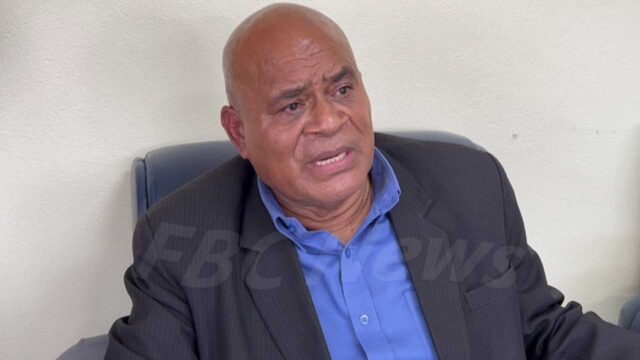

Lewai Karavaki, a Senior Manager at the Fiji Revenue and Customs Service, informed the High Court of this while testifying as the ninth prosecution witness in the trial of former Supervisor of Elections Mohammed Saneem and former Attorney General Aiyaz Sayed-Khaiyum.

When questioned by the state regarding the tax refund for the former Supervisor of Elections’ back pay, Karavaki stated that the employer is responsible for making proper deductions from an employee’s salary.

She added that individuals violate the law if they fail to pay taxes as stated in the Income Tax Act of 2015.

The FRCS manager stated that employers pay taxes for employees in certain circumstances, such as for expatriates.

For local public office holders, certain individuals, such as the President, are exempt from paying taxes as stipulated by law. This also applies to certain categories of taxes like dividends and superannuation.

Karavaki confirmed that she had reviewed Saneem’s tax records when police requested them for the case.

When asked if someone can contract out of paying tax, she replied that it is a matter between the employer and employee, and not a concern for the FRCS.

She also stated that Saneem did lodge his tax returns, but it was in November 2022, which incurred late penalties.

During cross-examination by the defense, she was asked if the additional clause in the second deed of variation for Saneem mentioned anything about tax exemption. She confirmed that there was nothing in the document stating exemptions for the former Supervisor of Elections.

She also confirmed that the Fijian Elections Office had updated his tax portal as his employer for issuing his tax withholding certificate.

Karavaki informed the court that the FEO had to be sent a document back because what was filed with the FRCS did not match their records.

According to Karavaki, the FEO’s financial controller had not reached out to her or the FRCS to seek guidance on how to process the new clause in Saneem’s Deed of Variation.

The defense also stated that the government did not pay for Saneem’s taxes, as the taxes were deducted from his salary, not from the government. The trial continues.

Sayed-Khaiyum is charged with abuse of office, while Saneem faces a charge of receiving a corrupt benefit. It is alleged that while acting as Prime Minister, Sayed-Khaiyum signed a Deed of Variation and Addendum approving the payment of Saneem’s taxes without proper authority, which gave Saneem a financial benefit.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Nikhil Aiyush Kumar

Nikhil Aiyush Kumar