Commercial farmers and Argo-processors who lack access to financing because they have no equity contribution can apply for an equity grant and loan package.

The Fiji Development Bank and the Ministry of Agriculture have partnered to promote the expansion of commercial agriculture by strengthening financial assistance to farmers and agro-processors.

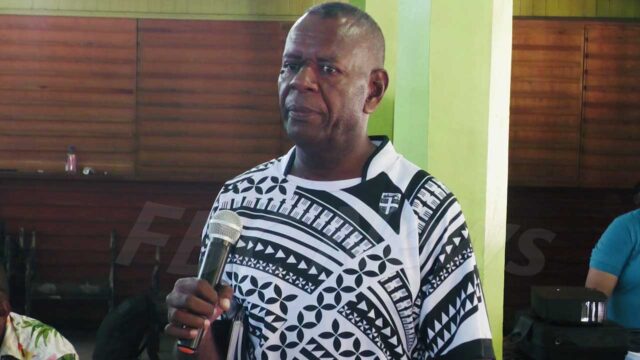

FDB Chief Executive Officer, Saud Minam, says FDB recognizes the financial barriers in the agriculture sector and they are working towards creating an enabling environment for farmers and agri-businesses to overcome such challenges.

He says this incentive will help remove the barriers that prevent the full participation of farmers, producers, and processors in accessing loans through digital channels from FDB.

“For example, if it is a $100,000 loan, a farmer wants to buy a tractor, he wants to buy some seed, fertilizer and he is short of money. He has got the land but he needs some equity so the equity of 20 percent which is $20,000, will come from the Ministry of Agriculture to the customer and the remaining 80 percent which is $80,000, we as FDB will come into financing them for a period depending on which farming he goes in.”

Minam says this package will help strengthen the food system, exports, create new market opportunities for farmers and processors, and help make supply chains more resilient to economic and natural shocks such as those caused by the pandemic and climate change.

He says this program will support targeted farmers to increase exports, household livelihood, income quality, and increase employment for Fijians in the long term.

Farmers whose farm sizes are five acres and above and are registered entities as well as those who are producers and processors of crop and livestock commodities can access loans from FDB up to $250,000 with the Ministry providing an equity contribution of 20%.

There are nine categories of borrowing entitlement whereby a grant of 20% of the total project cost will be paid by the Ministry and a loan from FDB of a maximum of 80% of the total project cost paid by the customer.

The Ministry will provide FDB with a list of approved applicants whereby the bank will then assess the applications using its own credit assessment criteria.

Praneeta Prakash

Praneeta Prakash