Discussions are in advanced stages between the Fijian government, the Asian Development Bank and the World Bank for the refinancing of the US$200 million global bond.

According to the 2019 and 2020 National budget the bond is due in October next year.

The government is asking ADB and World Bank to re-finance the bond through a policy based operation.

Refinancing of the global bond through a policy-based operation will assist in the implementation of various reforms, and help reduce the cost of borrowing and minimize refinancing risks.

Government says other bilateral partners have expressed interest to participate in this operation.

Apart from this, the World Bank Board of Governors earlier this year approved Fiji’s inclusion as an IDA-eligible Small Island Economy.

Effectively, this means that Fiji has become a “blend country”, which allows it to access funding approximately $55 million at zero interest on an annual basis with an extended repayment term of 40 years, including a 10-year grace period.

This funding is vital to support the financing of development and disaster resilience needs.

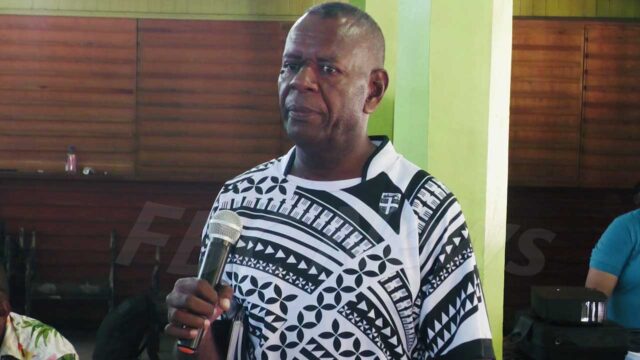

Aliki Bia

Aliki Bia