Many Small and Medium Enterprises in Fiji are unable to access traditional forms of finance, creating a financing gap that hinders the growth of the sector.

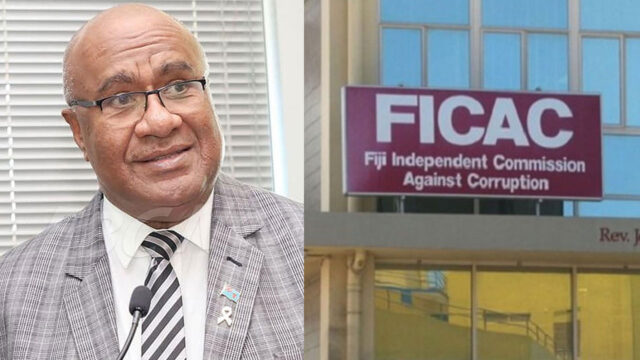

The cabinet has established and endorsed a working group that is tasked with gathering feedback from the public and business owners through consultations to address concerns and improve access to finance through the access to capital bill.

The Taskforce includes the Ministry of Trade Cooperatives, SMEs, and Communications, the Reserve Bank of Fiji, the Ministry of Finance, and the Asian Development Bank.

MSME Fiji Director, Faizal Khan believes closing the financial gap through alternative platforms will benefit the country’s growth.

“There’s about 2.2 billion financial gap so we have that this alternative platform will narrow that gap and ultimately as we empower and provide more finance to our MSMEs and business communities, we will put more money in their hands, empower them more that will drive more innovation, drive more employment, more economic activity, ultimately as MSMEs grown the whole country grows”.

Khan also highlights that the new bill aims to help SMEs in Fiji access funding when traditional banks are not an option.

“Therefore this bill or this policy legislation aims to target those businesses who are not able to access finance through the commercial bank or development banks so that’s why it’s called Alternative Form of Financing”.

This new policy aims to address the financing gap for SMEs in Fiji through alternative platforms, fostering economic growth and prosperity.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Ema Ganivatu

Ema Ganivatu