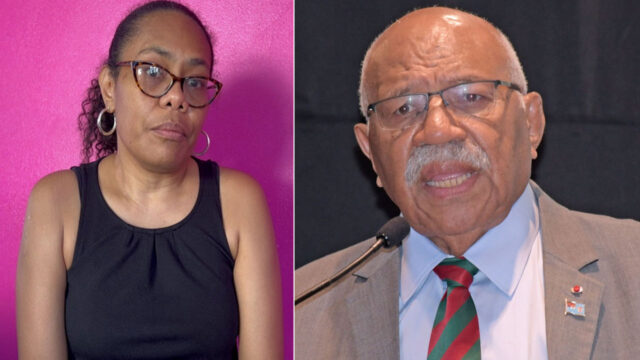

Jerome Powell, head of the Federal Reserve, says inflation in the US is too high [Source: Reuters]

The US central bank has pushed interest rates to the highest level in almost 15 years as it fights to rein in soaring prices in the world’s largest economy.

The Federal Reserve announced it was raising its key rate by another 0.75 percentage points, lifting the target range to 3% to 3.25%.

Borrowing costs are expected to climb more – and remain high, the bank said.

The move comes despite mounting concern that the cost of controlling inflation could be a harsh economic downturn.

Federal Reserve chairman Jerome Powell said the rate rises were necessary to slow demand, easing the pressures putting up prices and avoiding long-term damage to the economy. But he conceded that they will take a toll.

“We have got to get inflation behind us,” he said. “I wish there were a painless way to do that. There isn’t.”

Banks in nearly every country – with the big exceptions of Japan and China – are facing similar trade-offs as they raise rates to combat their own inflation problems.