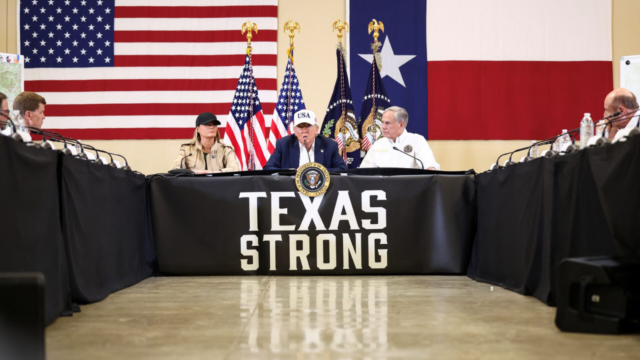

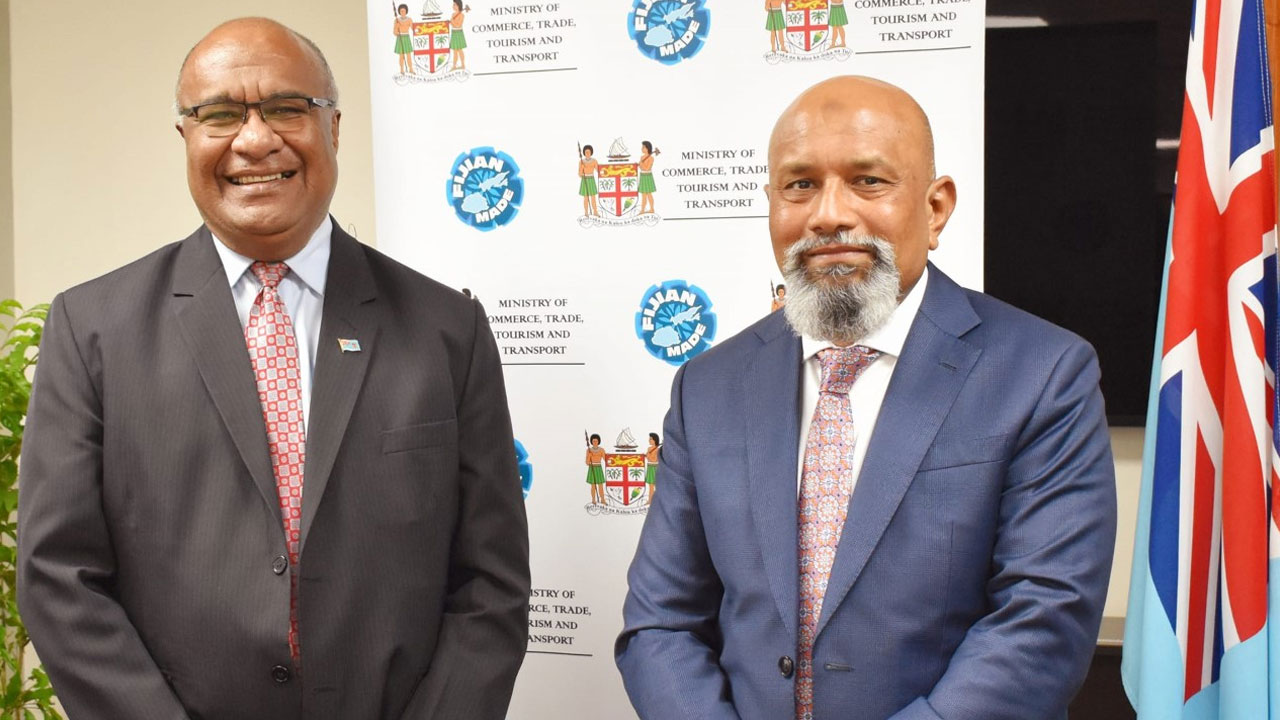

[Photo Supplied]

Micro, small and medium enterprises and agriculture now account for 94% of the Fiji Development Bank’s portfolio.

Chief Executive, Saud Minam revealed this in a briefing with the Deputy Prime Minister and Minister for Trade, Co-operatives, SMEs and Communications, Manoa Kamikamica.

Minam briefed the Minister on the bank’s efforts to assist MSMEs in sustaining and expanding their operations.

He says the number of customers has more than doubled from 4,500 to over 9,000 over the last 18 months.

Minam says the bank now has 24 percent, female customers, up from around 16 percent in the past.

He says these achievements in terms of our core business are a result of the tailor-made financial solutions launched in the past months.

Minam says this is particularly, the two new facilities that have greatly aided MSME – the SME Sustainability Package and the FDB Loan for Women Entrepreneurs.

The FDB team also provided a comprehensive overview of the bank’s operations to the Minister for Agriculture and Waterways, Vatimi Rayalu.

Minam says FDB’s total agriculture portfolio stood at 35 percent, equivalent to 3,188 customers.

He says the bank’s agriculture portfolio has the most customers, with sugarcane accounting for the majority, followed by root crops, livestock and fisheries.

Minam says the North has the most customers at 57 percent, the West is second at 27 percent, followed by the Central and Eastern at 17 percent.

The Minister for Trade, Co-operatives, SMEs and Communications and Minister for Agriculture and Waterways acknowledged FDB for developing the country in areas of agriculture, commerce and industry.

The CEO of FDB reaffirmed the bank’s commitment to developing financial solutions for specific sectors of the economy.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Simione Tuvuki

Simione Tuvuki