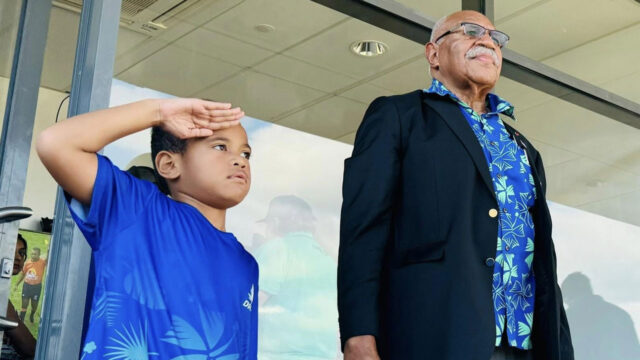

An employment application form is displayed during a restaurant job career fair organized by the industry group High Road Restaurants in New York City, U.S. [Source: Reuters]

The Federal Reserve is on track for half point interest rate increases in June, July, and perhaps even beyond as fresh job market data, Friday showed no sign the U.S. economy is buckling under the pressure of high inflation and rising borrowing costs.

A Labor Department report early Friday showed U.S. employers have added an average of 400,000 jobs each month since March, down from the nearly 600,000-per-month average pace from January 2021 to February of this year.

It is a downshift the Fed has reason to welcome, as it tries to tighten monetary policy fast enough to bring inflation down, but not so fast it triggers anything super bad.

Cleveland Fed President Loretta Mester called May’s job gains “strong” but said the slowing trend was “a good thing.”

“We want to see some moderation in both activity in growth and in the labor market to cool things off a little bit,” Mester told CNBC in an interview. “It’s too soon to say that’s going to change our outlook, or my outlook, for policy: The No. 1 problem in the economy remains very very high inflation.”

Mester said that unless she sees “compelling” evidence of falling inflation – now running at 40-year highs and more than triple the Fed’s 2% target – she will likely support yet another 50-basis point increase in September.

Stocks fell Friday and traders bet the Fed will end up lifting the policy rate to a range of 2.75%-3% by year’s end.

President Joe Biden said the data showed the economy was holding up even as the labor market shifted to a more sustainable pace of job growth.

“We aren’t likely to see the kind of blockbuster job reports month after month like we had over this past year. But that’s a good thing. That’s a sign of a healthy economy,” Biden said.

Many economists expected an even sharper slowdown, as tech firms announced layoffs or hiring freezes amid diving company stock prices, and on the assumption that consumers would begin scaling back given high inflation and rising food and energy bills.

“Payroll growth settled into a lower gear this spring but talk of an imminent recession is nothing more than fearmongering,” wrote EY-Parthenon Chief Economist Gregory Daco, noting that the United States is now less than 1 million jobs short of the peak level for non-farm payrolls hit just before the onset of the coronavirus pandemic. “Anecdotal evidence of hiring freezes and layoffs at tech companies is misleading with overall job openings still near record-highs and layoffs at record lows.”

The annual pace of wage growth slowed slightly and the labor force grew by an additional 330,000 workers, both developments that Fed policymakers hope will continue.