The Revenue and Customs Service has revealed that some prominent businesses have been caught manipulating customs duty values in order to avoid tax payments.

FBC News can confirm the tax fraud figures are running in millions for this year so far.

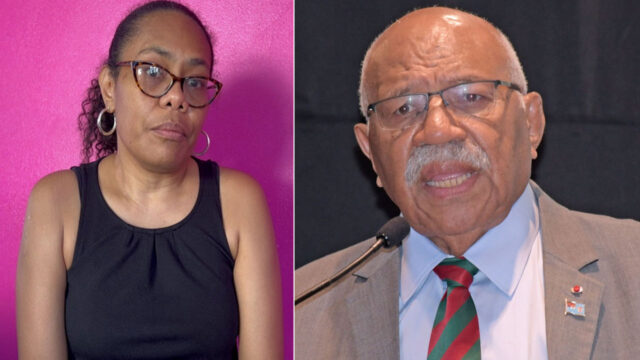

Director Revenue Management, Fazrul Rahman says this emerging trend has set warning bells for tax collectors.

Rahman says using false methods to beat the tax system is fast becoming a concern for the tax man and his team.

He adds this comes as some major business in the country have shown recorded losses with the tax department while continuing to under declare the value of imported goods to the customs department.

“Customs is a self-assessed system – we rely on the value that is being declared and if it is being seen that the values are simply being manipulated or manufactured. It not only has an impact on the customs duty collection but also on the income tax that the company needs to pay – something we are looking at a very integrated way.”

Rahman says this recent discovery has prompted the Revenue and Customs to conduct more investigations as they try to get to the bottom of the issue.

“It is something that is being seen as a recent emerging trend in Fiji -which means that FRCS needs to study the importance and their relationship with their suppliers. Is it at arm’s length relationship or is something that is leading to a situation where invoicing can be manipulated.”

Revenue and Customs says while it is rather unfortunate certain taxpayers would opt to cheat the system, there is no way these businesses will be able to get around the super tight tax laws of the country.

Those caught in tax fraud will be subjected to hefty fines and even serving time in prison.