The Fiscal Review Committee has explained the reasons behind its suggestion to increase the value-added tax between 12.5 percent and 15 percent and have no zero-rating on essential items.

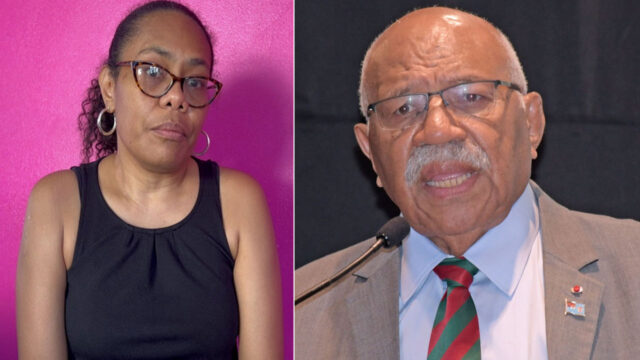

Speaking on ‘Saqamoli Matters’ last night, Committee Member Lisa Apted stated that just over 20, 000 people in Fiji pay personal income tax.

Currently, people who are only earning $30, 000 or more pay income tax.

“That is such a small percentage of our population. So that statistic and that platform kind of brings us to the only solution in VAT. Which is VAT is the only part which everybody pays. It has the broadest touch points across the population. So we are forced as a revenue measure to look towards that.”

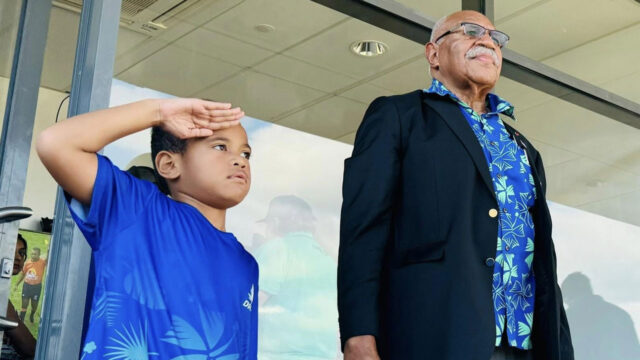

Fiscal Review Committee Chair Richard Naidu says the Fijian economy can only grow with reliable water and power supplies as well as good health services.

But Naidu warns that this can only be done if the government gets enough money to spend.

“We have to find the money for critical infrastructure. We have to find money for water, we have to find money for power, and we have to find money for our health facilities. So how are we going to make all of this work?”

Naidu further states that they are being criticized for recommending increasing the VAT.

However, he explains why the government cannot reach more people.

“So when people say don’t increase VAT, just tax people and tax companies. We can’t tax people anymore. There is no room. We can tax companies a little bit more but I think even increasing the corporate tax rate from 20 to 25 percent that only gives us $70m a year. And we are looking for something like five or six hundred million dollars net for government to actually begin to improve the fiscal situation that we are facing.”

The Fiscal Review Committee has collectively suggested that increasing the VAT will be a viable option for the government.

The 2023–24 National Budget will be announced on June 30th.

Ritika Pratap

Ritika Pratap