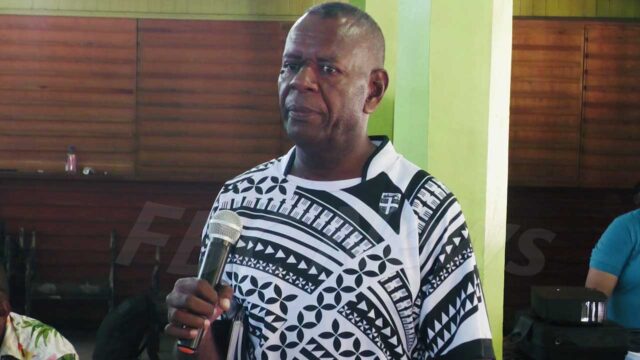

Fiji Revenue and Customs Services chief executive Visvanath Das

A high number of traders continue to find loopholes in our tax laws to evade paying taxes.

Fiji Revenue and Customs Services chief executive Visvanath Das is disappointed that some unscrupulous tax-payers continue to defraud the government.

Das adds the Vat Monitoring System was introduced with the aim to reduce un-ethical practices, however, immoral tax-papers always find a way through this.

“Some tax-payers they may have multiple POS lanes and have fiscalise four lanes and not the fifth lane so they are hooked up to the system so if anyone their POS lanes goes offline we can know it immediately here at the office but where the POS lane is completely not fiscalised in the first instance then that, of course, is dependent on the relationship between the POS provider, taxpayers and tax office.”

Das says this corrupt practice prompted the issuance of infringement notices.

“Of course you can misconstrue and say FRCS is becoming very draconian but people would not say why it was issued. When we put our inspectors on the ground there were tills being operated that were not issuing fiscalised receipts so infringement notices were issued which had fines ranging up to $50 thousand or so.”

Das adds in the near future Revenue and Customs officers will be on the ground, conducting investigation.

The tax-man says an improvement in compliance rate has been recorded from 60% to 90%, however, there is still a grave worry of tax evasion.

Rachael Nath

Rachael Nath