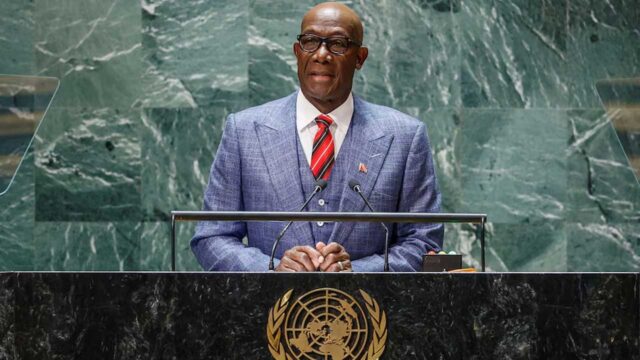

Photo: AFP

Softer loan growth and narrower interest rate margins have combined with a gloomy business outlook to keep retail banks’ profits in check.

Advisory firm KPMG’s survey of financial institutions for the June quarter shows the sector’s net profit fell close to half a percent to $1.45 billion, a fairly flat result after a near 9 percent increase in the previous three month period.

KPMG’s head of banking and finance John Kensington said banks could not be expected to reach new profit levels every quarter.

“To get large profit growth for the banks, you need to have strong loan growth, and loan growth this quarter was 1.2 percent, or you need to have an improvement in margins and they didn’t have that either,” he said.

Caution in the wake of the 2018 bank conduct and culture review and the looming RBNZ decision on increased capital requirements for banks were also factors.

“Confidence is not that great in the market at the moment and we’re kind of in winter at the moment so it didn’t surprise me that it was flat.

“We’re probably lucky to have not have seen it go backwards, to be honest,” Mr Kensington said.