The Reserve Bank of Fiji kept the overnight policy rate unchanged at 0.5 percent at its meeting yesterday.

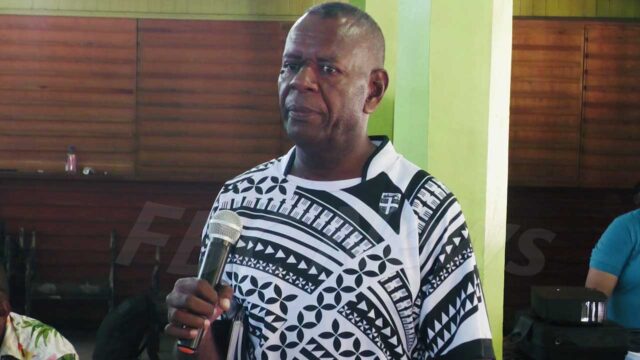

Reserve Bank Governor and Board Chairman Arif Ali, stated that while the Bank’s objectives remained intact, major sectoral performances have been mixed with total demand softening in line with the 1.0 percent and retail sales surveys, private sector credit growth further slowed in October.

Inflation has been decelerating since mid-year and turned negative.

Consumer prices declined annually by 0.9 percent in October compared with the 0.4 percent increase noted a month earlier and is much lower than the 5.2 percent growth recorded in the same month a year ago.

All major categories noted a decline in prices, with the exception of food & non-alcoholic beverages. Given the aggregate, demand is forecast to remain soft.

The decline in imports amid continuous growth in tourism and remittance receipts has led to an improvement in foreign reserves of around $180 million since the end of 2018.

Foreign reserves were $2.1 billion at the end of November, sufficient to cover five months of retained imports of goods and services and are forecast to remain at comfortable levels over the medium-term given the modest outlook for import growth and uptick in tourism and remittance inflows.

While the Reserve Bank’s money policy objectives are intact, accommodative macroeconomic policies are needed to raise growth whilst maintaining price and external stability.

The current accommodative monetary policy stance remains appropriate and is supported by surplus bank liquidity which was above $600 million throughout November.

Koroi Tadulala

Koroi Tadulala