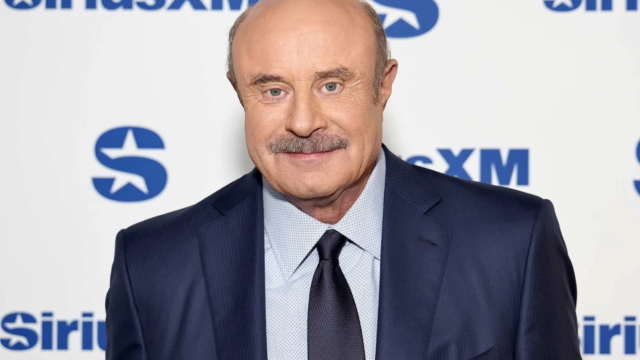

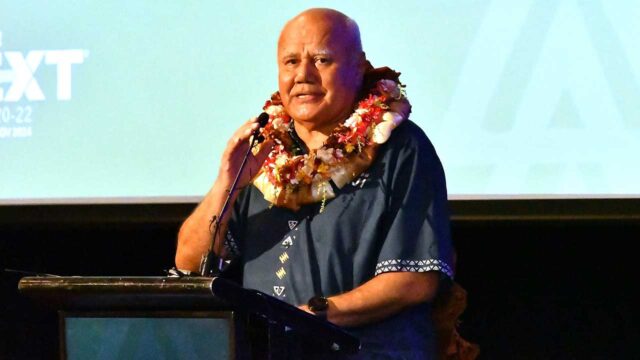

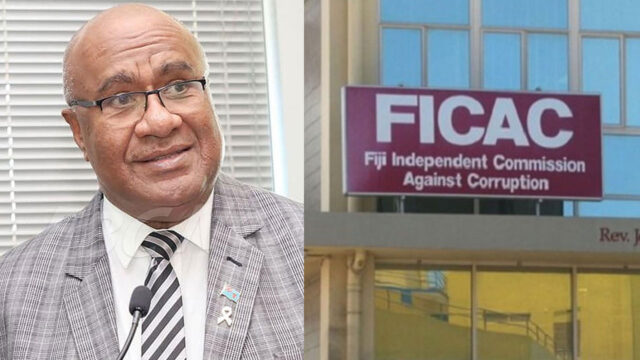

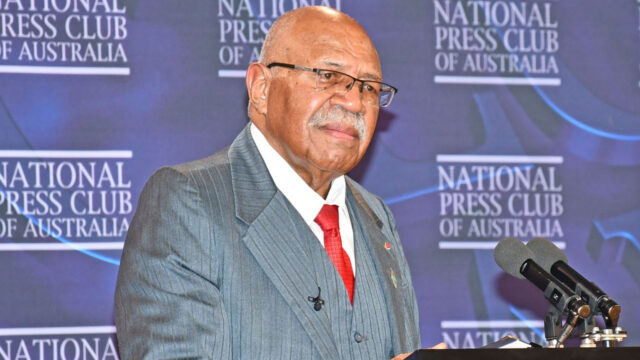

Prime Minister, Sitiveni Rabuka says they will have to take some hard decisions and sacrifices that will not be pleasant but necessary for the common good.

While delivering the state of the nation’s address, Rabuka says the 2023-24 national budget will be people-centered and adjustments will be made to ensure sustainable economic growth in the short and medium term.

While taking a balanced approach, Rabuka says they must find ways to increase government revenue collection, which may mean pain for people.

He adds that as our current debt burden is extremely high at 85 percent of GDP, revenue collection must be more robust.

The revenue policy reforms will be guided by principles of fairness, simplicity and revenue-adequacy.

Rabuka says these changes will be reflected in the new plan for Fiji Revenue and Customs Service and the new compliance improvement strategy.

The Prime Minister says policies will be implemented to reduce the intake of junk food and increase domestic and organic food production, which will in turn improve the wellbeing of our people.

“Our tax system offers extremely attractive incentives and customs concessions to support the growth and diversification of our economy. These incentives will target key growth sectors, including new tax-free zones, so that the whole of Fiji can prosper and grow. Our priorities must change to achieve better productive outcomes with the minimum social cost. The Budget will ensure sustained economic growth in the short and medium term. This will progressively address our debt problem.”

He adds that the key initiatives they are considering under this National Budget are the Value Added tax, which will be simpler than before, and total expenditure, which will remain at a manageable level.

“Infrastructure spending will be managed with greater diligence, and the Capital to Operating Expenditure Ratio will be maintained at 30:70. Rural roads will be upgraded so that rural economy and agriculture performance can be improved. Social welfare benefits for elderly citizens will be increased to cushion the rising cost of living and meet the needs of recipients. Health Expenditure will be increased so that our healthcare services and facilities can be improved.”

He further states that the Education sector remains our priority, so our expenditure commitment will be retained, and allocation for skills training will be significantly improved to fill the gaps that exist due to the migration of our workers.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Kreetika Kumar

Kreetika Kumar