The Fiji National Provident Fund addressed a critical issue plaguing pensioners whereby they were retiring with sums below $20,000 in their retirement funds.

FNPF attributed this alarming trend to outdated policies that encouraged members to treat their funds as a casual bank resulting in frequent and substantial withdrawals.

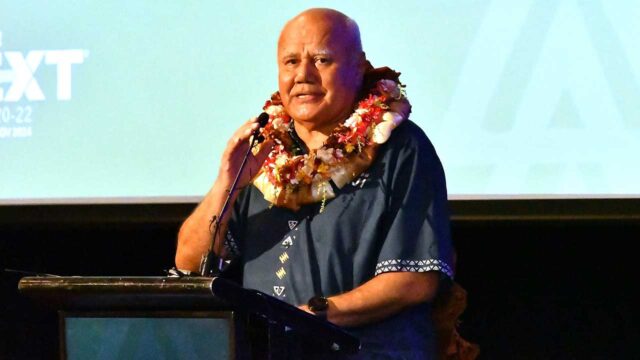

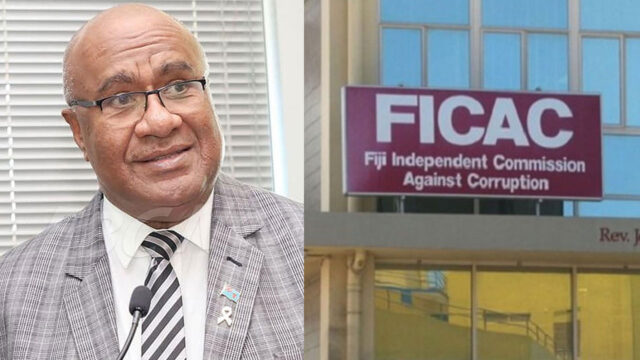

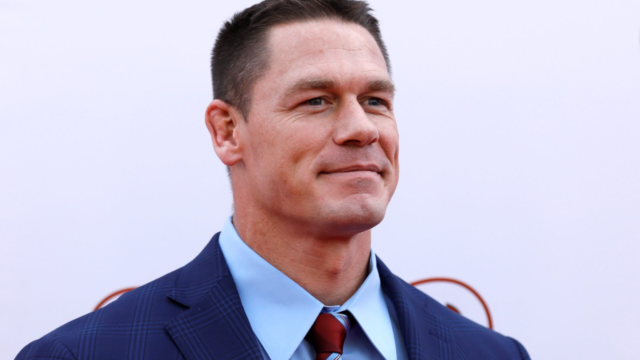

FNPF’s General Manager for Member Services Alipate Waqairawai says the previous policy allowing members to withdraw 70 percent was a detrimental factor, defeating the very purpose of establishing retirement funds.

Waqairawai highlights that prior policies encouraged early withdrawals, prompting the preservation policy shift.

“When we did the reforms that was one thing we were to change the preservation policy. 30% is preserved for your general account which allows for 5 grounds of withdrawals, which was reduced from 23 grounds of withdrawals. Members were treating the fund as if it were their bank. FNPF is not a bank, it’s for your retirement”.

The recent discussions at the FNPF Forum highlights the importance of retirement planning and the challenges faced by members serving as a wake-up call for policymakers and stakeholders to prioritize reforms ensuring the long-term viability of retirement funds.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Rowena Acraman

Rowena Acraman