Reserve Bank of Fiji. [File Photo]

The Reserve Bank of Fiji has maintained its Overnight Policy Rate at 0.25 percent, keeping its accommodative monetary stance to support stable inflation and adequate foreign reserves.

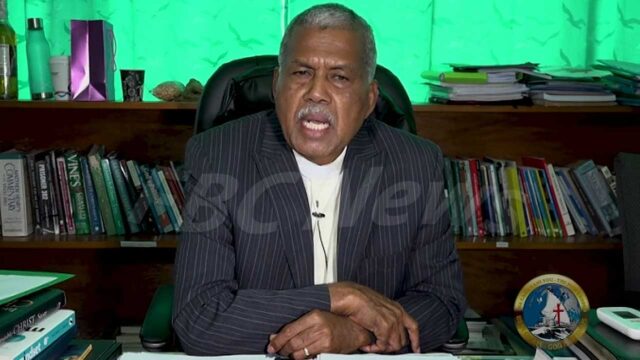

Governor and Board Chairman Ariff Ali says annual headline inflation dropped further to -3.5 percent in August, compared to -1.5 percent in July and 3.8 percent a year ago. He attributed the decline mainly to the VAT reduction and bus fare subsidy, along with lower food, transport and fuel prices.

Ali cautioned that risks remain due to geopolitical tensions affecting global commodity prices and the upcoming cyclone season.

Foreign reserves remain comfortable at around $3.8 billion, covering six months of imports.

The Fiji Bureau of Statistics reports the economy grew by 3.5 percent in 2024, following 9.4 percent growth in 2023, largely driven by services, agriculture and manufacturing. Growth this year is forecast at 3.2 percent, although sector performance remains mixed.

Visitor arrivals reached 642,810 by August, a 0.4 percent rise supported by strong numbers from the US, Pacific, UK and Europe, and a recovery in arrivals from Australia and New Zealand.

Consumption remains strong, supported by higher disposable incomes, remittance inflows and increased lending, while investment activity has picked up with more building permits, higher imports of construction materials and easing prices.

Liquidity in the banking system stands at $2.2 billion, with low interest rates supporting growth.

Ali says global uncertainty continues to pose risks, but the RBF will monitor developments closely and adjust policy if needed.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Mosese Raqio

Mosese Raqio