Reserve Bank of Fiji

The Reserve Bank of Fiji Board decided to maintain the Overnight Policy Rate at 0.25 percent at its meeting.

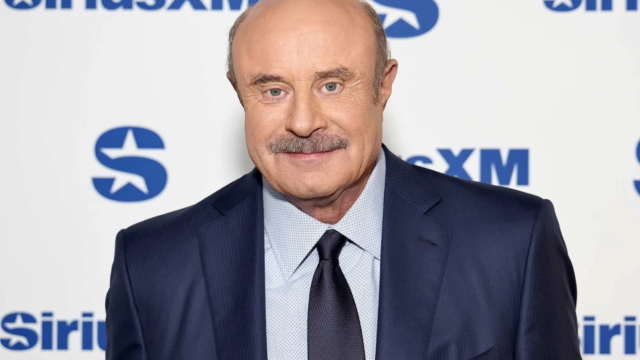

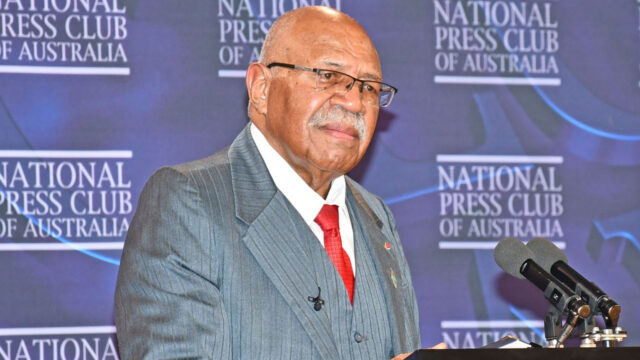

The Governor and Board Chairman, Ariff Ali, says that the accommodative monetary policy stance remains appropriate given the downward revision to the 2024 growth forecast.

He says the Fijian economy has fully recovered from the pandemic, one year earlier than projected following the very promising recovery in the tourism industry and its positive flow-on effects to other sectors.

Based on the recent data on tourism activity as well as consumption and investment indicators, the economy is projected to grow by 8.2 percent in 2023.

RBF Governor and Board Chairman, Ariff Ali [File Photo]

The Governor adds that the financial sector continues to support domestic economic activity, with private sector credit expanding by 5.9 percent in October due to higher lending to business entities and households.

Ali says liquidity in the banking system was adequate at around $2.2 billion, keeping interest rates at historic lows.

On RBF’s twin monetary policy objectives, Ali says that the annual headline inflation was 5.8 percent in November as higher prices were recorded across most categories with year-end inflation projected to be around six percent.

[File Photo]

However, annual average inflation is expected to moderate to around 3.6 percent in 2024.

As of 06 December, foreign reserves stood at around $3.4 billion, sufficient to cover 5.7 months of retained imports of goods and services and are projected to remain adequate over the medium term.

The Governor says that despite the slowdown in global growth, Fiji’s macroeconomic growth prospects are positive, and the outlook for RBF’s twin monetary policy objectives are within comfortable levels.

The RBF will continue to monitor global and domestic economic developments and their implications on the current outlook and align monetary policy accordingly.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Praneeta Prakash

Praneeta Prakash