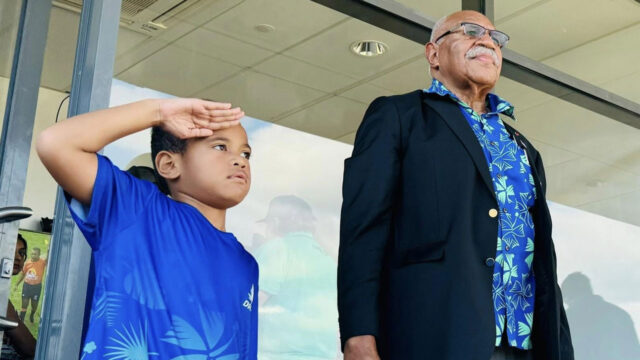

Former Reserve Bank Governor Graeme Wheeler. [Source: NZ Herald]

Former Reserve Bank Governor Graeme Wheeler says central banks made serious errors in the wake of the Covid-19 pandemic which now need to be acknowledged and corrected.

In a new research paper co-authored by Bryce Wilkinson for the New Zealand Initiative the pair are highly critical of the loose monetary policy and quantitative easing that occurred and which they argue has been the primary driver of inflation.

The paper argues central banks were too confident about their monetary policy framework; were too confident about their models; were too confident they could control output and employment.

It suggests they lost their focus on price stability and took on too many mandates.

It also argued they faced conflicts in some cases with conflicting “dual mandate” objectives; and were distracted by extraneous political objectives, such as climate change.

The report stops short of directly attacking the RBNZ but makes some highly specific criticisms and refers to the local bank.

For example the Reserve Bank of New Zealand Act was amended by the Labour Government in 2018 to create a dual mandate, adding employment as a policy target.

“The RBNZ is tasked with maintaining a stable general level of prices over the medium term and supporting maximum sustainable employment,” the paper says.

It also argues central banks took their eyes off the ball with broader policy initiatives – a point it illustrates by highlighting the RBNZ’s work integrating a Māori world view into its outlook.

“Confident in their ability to maintain low inflation, central banks in recent years

began diverting resources to other topics such as climate change and inequality (and in the case of the RBNZ also embracing New Zealand’s indigenous history and culture and adopting a Māori world view in the operations of the central bank),” the report says.

“Such issues bear little if any relationship to the reasons why central banks exist

– ensuring price stability and financial stability.”

Central banks now needed to must ensure that they had “first rate financial market expertise on their monetary policy committees and boards. Trite responses about “having no regrets”, “would not do anything differently” and “there is no alternative” are irresponsible and further damage a central bank’s credibility,” the report says.

Central bankers needed to learn from their misjudgements because “the social, economic, and political consequences of major mistakes run deep and the trust and confidence that the public have in them can be readily depleted.”

In a podcast produced by the NZ Initiative to accompany the paper, Wheeler says he thinks central banks “have made some serious errors of judgment in conducting monetary

policy over the last two years.”

“We’ve got inflation at a 40-year high, and if you look at the US over the last two years, you’ve had inflation of 14 per cent, 12 per cent in the UK.”

“Now some central banks suggested that this was due to damaged supply lines due to Covid restrictions for example. The shortage of microprocessors from Taiwan, for example, or it was due to Russia’s invasion of Ukraine and the impact on energy prices, wheat and fertiliser.”

They were factors that had affected inflation, he said.

“But they are not in any way the main drivers of inflation.”

The economic and financial consequences of central bank mistakes will be serious and felt worldwide, said Wilkinson. “The poorest and most vulnerable will be hit hardest by monetary policy errors.”

Wheeler who was Reserve Bank Governor from 2012 to 2017 acknowledged mistakes were made during his tenure that he now regrets.

The RBNZ raised rates three times in 2014 and then had to reverse those moves.

“[I’m] conscious that you know if you live in a glass house you shouldn’t throw

stones, but I’m very keen to collaborate with Bryce on this paper because the mistakes that have been made by central banks are so grievous,” he said on the podcast.

Since 2017 Wheeler has served as an independent non-executive director on

major companies in Zurich and Beijing. He also writes on global economic policy issues.