Rising geopolitical risks are casting a shadow over an otherwise steady end-of-year global economy, according to the Reserve Bank of Fiji’s November Economic Review.

Analysts warn that fresh strains in Asia and renewed nuclear talk among major powers could unsettle supply chains and investor confidence.

Global business activity held its ground late in the year despite weak sentiment and shrinking trade. Services continued to drive most of the expansion, while manufacturing posted only a modest lift.

Analysts say easing US–China tensions, the rollback of US reciprocal tariffs on more than 200 food products and the end of the US government shutdown have helped restore some confidence among investors and consumers.

Regional experts warn that worsening strains between Japan and China could disrupt key supply routes, while the latest talk in Washington and Moscow of possible nuclear test resumptions is adding to security worries.

At the same time, a US-backed Gaza stabilisation plan won support at the UN Security Council, and renewed diplomacy has placed Ukraine–Russia peace talks back into view.

Commodity markets delivered mixed signals. Brent crude slid sharply over the month and the year as rising OPEC+ output outweighed concerns linked to US sanctions on Russian oil.

Food prices eased across cereals, dairy and meat. Sugar also fell as cane supply prospects improved across Brazil, Thailand and India. Gold was the exception, climbing to US$3,996.50 per ounce as uncertainty and sustained central bank buying kept demand high.

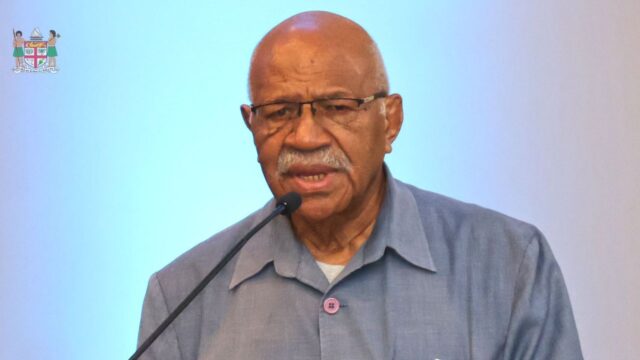

In Fiji, the outlook remains positive.

The Reserve Bank lifted its 2025 growth forecast to 3.4 per cent, saying the projection reflects steady consumption, an improved investment climate, sustained public spending and mostly favourable indicators up to October.

Visitor arrivals edged higher, supported by the United States, the Pacific, the United Kingdom and Europe. Australia and New Zealand weakened.

Timber production rose on favourable weather, and electricity output firmed. Mineral water exports declined on softer US demand, and gold ore output fell as Vatukoula Gold Mines shifted to exporting concentrates.

Sugar production also fell despite more cane harvested, mainly due to poor cane quality, mill problems and adverse weather.

Labour conditions continued to normalise. Job ads declined as more vacancies were filled. Formal employment registrations rose and outward migration eased.

Work permit approvals dropped, signalling reduced demand for foreign labour.

Consumption held firm. New consumption lending increased, PAYE collections grew on higher wages and remittances remained steady.

Vehicle registrations rose across new and used categories.

Investment indicators showed a mixed picture. Construction-related imports rose on stronger demand for industrial inputs and building materials, though new investment lending dipped as lending to construction slowed.

Financial conditions stayed supportive.

Broad money expanded, liquidity remained high at $2.1 billion and lending rates fell to record lows.

The Fijian dollar weakened over the year against major currencies except the New Zealand dollar but strengthened against most currencies on the month.

The trade deficit widened as imports grew faster than exports. Gains in gold-related products, woodchips and kava helped offset lower sugar, mineral water and mineral fuel re-exports.

Inflation stayed in negative territory at -1.4 percent in November, driven by lower food, transport, cooking gas and fuel prices. Foreign reserves held at $3.9 billion, equal to 5.8 months of imports.

The Reserve Bank kept the policy rate at 0.25 per cent, citing stable inflation and strong reserves.

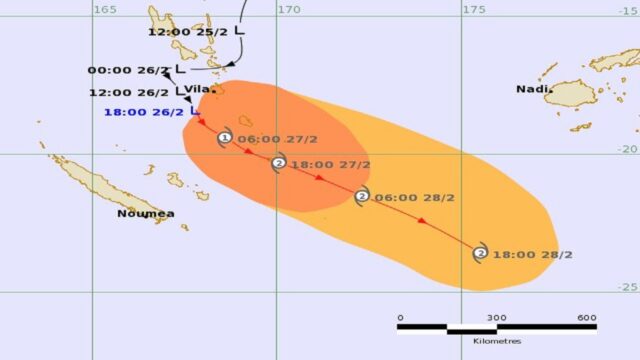

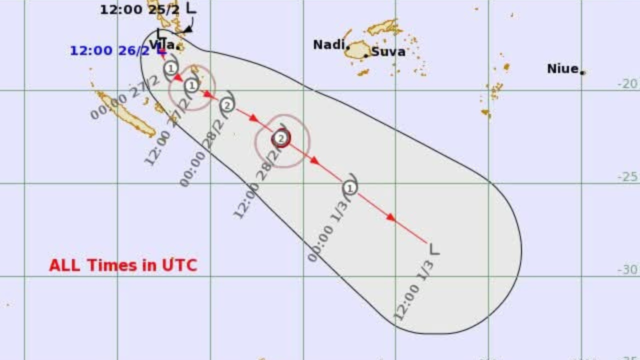

It warned that global tensions, fragile external demand and domestic structural challenges still pose risks especially with the cyclone season underway.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Litia Cava

Litia Cava